You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Help me choose Income tax regime

- Thread starter titli9830

- Start date

-

- Tags

- #incometax income tax itr

TaxWiser

KF Mentor

The calculations below are indicative and assume no additional exemptions, deductions, or investments beyond the standard deduction of ₹75,000. Final tax liability may vary depending on factors such as eligible deductions (like HRA, Section 80C, 80D, etc.), exemptions, or other personal considerations. Please consult a tax advisor or use a detailed tax calculator for precise figures.

Summary:

Category | New Tax Regime (FY 2025-2026) | New Tax Regime (FY 2024-2025) | Old Tax Regime |

Taxable Income Slab |

|

|

|

Standard Deduction | ₹75000 | ₹75000 | ₹50000 |

Tax Breakdown |

|

|

|

Total Tax | ₹1,70,800 | ₹2,46200 | ₹3,76,200 |

Summary:

- The new tax regime results in lower tax liability but doesn't allow deductions (other than the standard deduction).

- The old tax regime can be favorable if you avail deductions like HRA, Section 80C, and others.

Last edited:

The calculations below are indicative and assume no additional exemptions, deductions, or investments beyond the standard deduction of ₹75,000. Final tax liability may vary depending on factors such as eligible deductions (like HRA, Section 80C, 80D, etc.), exemptions, or other personal considerations. Please consult a tax advisor or use a detailed tax calculator for precise figures.

- ₹0 - ₹4 lakh: No tax

- ₹4 - ₹8 lakh: 5%

- ₹8 - ₹12 lakh: 10%

- ₹12 - ₹16 lakh: 15%

- ₹16 - ₹20 lakh: 20%

- ₹0 - ₹2.5 lakh: No tax

- ₹2.5 lakh - ₹5 lakh: 5%

- ₹5 lakh - ₹10 lakh: 20%

- ₹10 lakh and above: 30%

- ₹4 lakh - ₹8 lakh: ₹4 lakh × 5% = ₹20,000

- ₹8 lakh - ₹12 lakh: ₹4 lakh × 10% = ₹40,000

- ₹12 lakh - ₹16 lakh: ₹4 lakh × 15% = ₹60,000

- ₹16 lakh - ₹19.29 lakh: ₹3.29 lakh × 20% = ₹65,800

- ₹2.5 lakh - ₹5 lakh: ₹2.5 lakh × 5% = ₹12,500

- ₹5 lakh - ₹10 lakh: ₹5 lakh × 20% = ₹1,00,000

- ₹10 lakh - ₹19.29 lakh: ₹9.29 lakh × 30% = ₹2,78,700

₹1,85,800 ₹3,91,200

₹75,000 ₹75,000

₹1,10,800 ₹3,16,200

Summary:

(Source: Conversation with Gemini AI)

- The new tax regime results in lower tax liability but doesn't allow deductions (other than the standard deduction).

- The old tax regime can be favorable if you avail deductions like HRA, Section 80C, and others.

For the same figures, if we consider 1.5L investment to PPF and 50K contribution to NPS, 50k insurance premium for the whole family (1 parent, 2 couple, 2 kids) how much would be the tax in old regime?

TaxWiser

KF Mentor

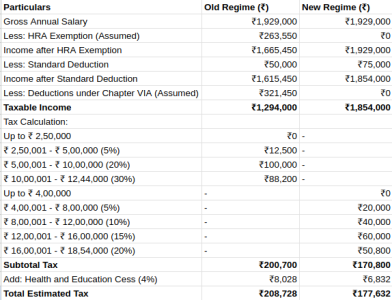

Under the old tax regime, your taxable income can be reduced significantly by leveraging deductions for investments in PPF, NPS, and insurance premiums. Here's the calculation:For the same figures, if we consider 1.5L investment to PPF and 50K contribution to NPS, 50k insurance premium for the whole family (1 parent, 2 couple, 2 kids) how much would be the tax in old regime?

■ Gross Salary: ₹19,29,000.

■ Standard Deduction: ₹50,000.

- Taxable Income: ₹19,29,000 - ₹50,000 = ₹18,79,000.

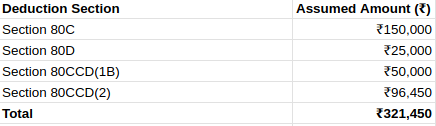

■ Deductions:

- Section 80C: ₹1,50,000 for PPF investment.

- Section 80CCD(1B): ₹50,000 for NPS contribution.

- Section 80D: ₹50,000 for health insurance premium (family + senior parent).

- Total Deductions: ₹1,50,000 + ₹50,000 + ₹50,000 = ₹2,50,000.

■ Net Taxable Income: ₹18,79,000 - ₹2,50,000 = ₹16,29,000.

■ Tax Slabs:

- ₹0 - ₹2,50,000: No tax.

- ₹2,50,001 - ₹5,00,000: 5% = ₹12,500.

- ₹5,00,001 - ₹10,00,000: 20% = ₹1,00,000.

- ₹10,00,001 - ₹16,29,000: 30% = ₹1,88,700.

■ Total Tax: ₹12,500 + ₹1,00,000 + ₹1,88,700 = ₹3,01,200.

(Source: ClearTax)Seems like still new tax regime is good.Under the old tax regime, your taxable income can be reduced significantly by leveraging deductions for investments in PPF, NPS, and insurance premiums. Here's the calculation:

■ Gross Salary: ₹19,29,000.■ Standard Deduction: ₹50,000.

- Taxable Income: ₹19,29,000 - ₹50,000 = ₹18,79,000.

■ Deductions:

- Section 80C: ₹1,50,000 for PPF investment.

- Section 80CCD(1B): ₹50,000 for NPS contribution.

- Section 80D: ₹50,000 for health insurance premium (family + senior parent).

- Total Deductions: ₹1,50,000 + ₹50,000 + ₹50,000 = ₹2,50,000.

■ Net Taxable Income: ₹18,79,000 - ₹2,50,000 = ₹16,29,000.

■ Tax Slabs:

- ₹0 - ₹2,50,000: No tax.

- ₹2,50,001 - ₹5,00,000: 5% = ₹12,500.

- ₹5,00,001 - ₹10,00,000: 20% = ₹1,00,000.

- ₹10,00,001 - ₹16,29,000: 30% = ₹1,88,700.

■ Total Tax: ₹12,500 + ₹1,00,000 + ₹1,88,700 = ₹3,01,200.(Source: ClearTax)

Similar threads

- Replies

- 0

- Views

- 337

- Replies

- 1

- Views

- 66

- Replies

- 1

- Views

- 515

- Replies

- 0

- Views

- 310