Hi

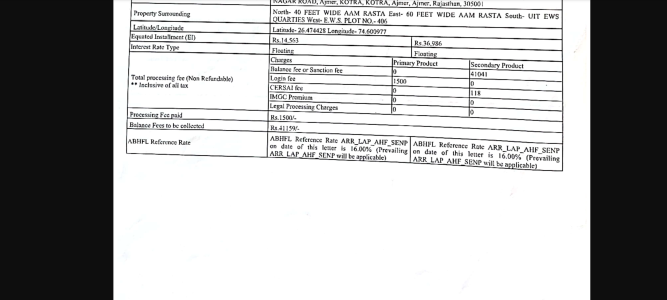

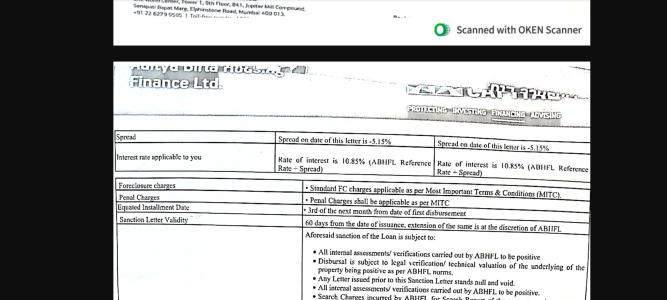

We have a loan of 45lac from Aditya birla roi 10.7% mortgage loan after 1.2year 43.8 lac is remaining we want to close this loan as we hot a home loan at 7.7%bob but Aditya Birla asking for foreclosure charges i.e 4% very high thought rbi have removed these charges now confused what to do negotiate or complain in RBI for this

Help for better decision

We have a loan of 45lac from Aditya birla roi 10.7% mortgage loan after 1.2year 43.8 lac is remaining we want to close this loan as we hot a home loan at 7.7%bob but Aditya Birla asking for foreclosure charges i.e 4% very high thought rbi have removed these charges now confused what to do negotiate or complain in RBI for this

Help for better decision