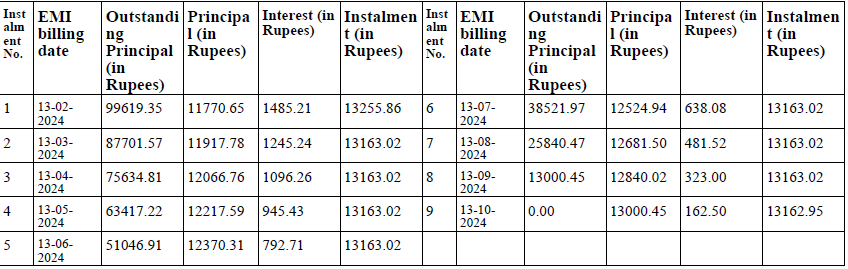

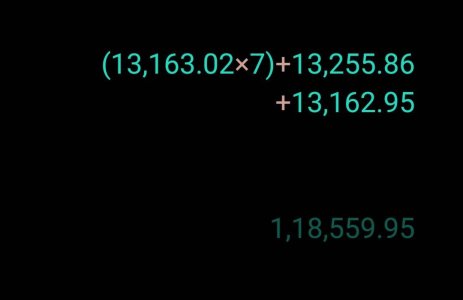

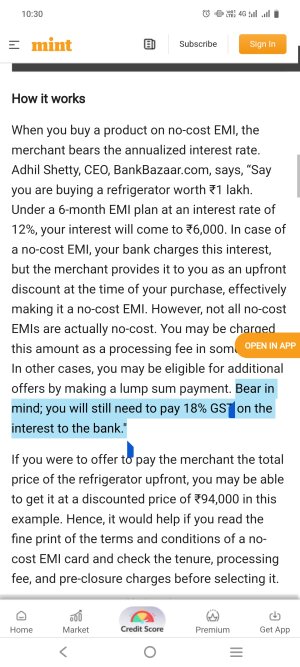

I had a no cost emi for 1.18 lks for 9 months , i was told only processing fees of 199 + gst will be deducted now i am see gst every month on the interest amount !!

Any way to get the 1261 back from the bank ?

Attach the total calculation excludung the processing fees !!

Any way to get the 1261 back from the bank ?

Attach the total calculation excludung the processing fees !!