shivamid6

KF Expert

Hi,

I have 2 Axis Bank Credit Cards both cards has a merged limit of 31k.

1st credit card bill generation date is 2nd of every month.

2nd credit card bill generation date is 13th of every month.

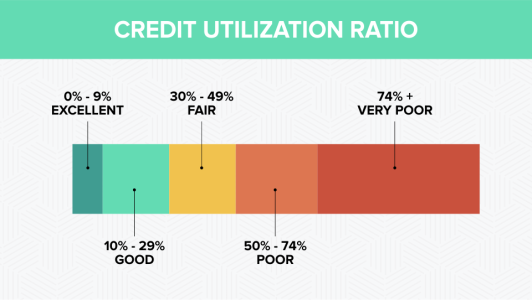

I know the 30% usage rule.

My question is, on 2nd of every month if my 1st card bill is less than 30% of merged overall limit

But

In my 2nd card I have used 1000 rs. till 2nd of the month.

Then in this case my 1st card usage will be counted as less than 30% or 2nd card spend will also be counted in it and it will be counted as more than 30% limit.

Please let me know.

I have 2 Axis Bank Credit Cards both cards has a merged limit of 31k.

1st credit card bill generation date is 2nd of every month.

2nd credit card bill generation date is 13th of every month.

I know the 30% usage rule.

My question is, on 2nd of every month if my 1st card bill is less than 30% of merged overall limit

But

In my 2nd card I have used 1000 rs. till 2nd of the month.

Then in this case my 1st card usage will be counted as less than 30% or 2nd card spend will also be counted in it and it will be counted as more than 30% limit.

Please let me know.