Mere pass already 6 Cards he

Total limit 6L +

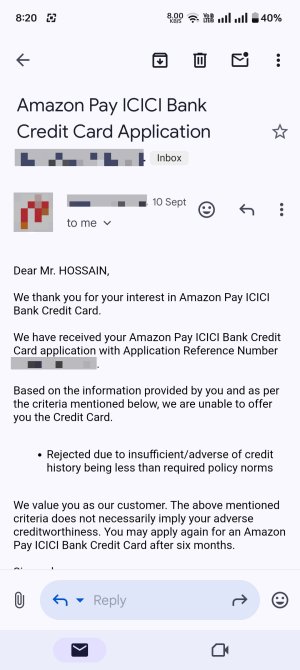

Cibil 779 and utilization 7% Abhi tk koi bhi card reject nhi hua but Amazon pay ICICI credit Card ajent ki help se on call apply kia fir uske baad not eligible show hone laga maine notice kia ki aj tk maine bhi aj tk koi bhi order nhi kia amazon se sirf bill payment and recharge kia he bss shayad rejected hua he card Bhai ap batao kya kru mai icici card k liye tabhi

Total limit 6L +

Cibil 779 and utilization 7% Abhi tk koi bhi card reject nhi hua but Amazon pay ICICI credit Card ajent ki help se on call apply kia fir uske baad not eligible show hone laga maine notice kia ki aj tk maine bhi aj tk koi bhi order nhi kia amazon se sirf bill payment and recharge kia he bss shayad rejected hua he card Bhai ap batao kya kru mai icici card k liye tabhi