Best Cashback Credit Card For 2024 - PIX789

Writing this post truly based on my Personal Experience, after using this credit card for 3 months.

I have used many cards until now, but this card has given me the true benefits of holding a credit card.

These benefits are very simple in understanding and can be evaluated without any complexity.

As of 31-Mar-2024,

I believe that, the Best Cashback Credit Card For 2024 is Standard Chartered Smart Visa Platinum Credit Card !!!

Though, this card has a joining and renewal fees of Rs 499 + GST but the cashback is too good.

Renewal fees are waved off, if we spend more than Rs 1,20,000 in a year !

Cashback Details:

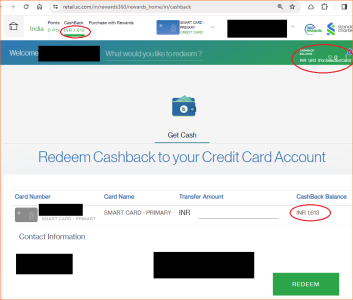

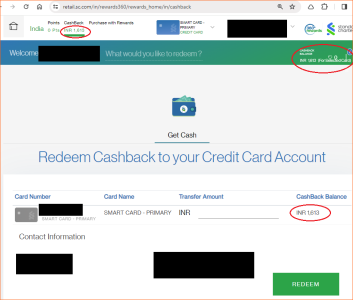

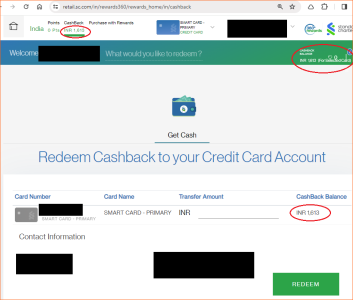

1. Cashback redemption is allowed at a minimum of Rs 1000 and then in multiples of Rs 500 thereafter, with ZERO redemption fees.

2. Cashback is adjusted in the next credit card statement.

3. Cashback is available on its internal Reward Portal.

4. Cashback is eligible on a minimum transaction of Rupee One

5. Cashback from ONLINE spends is 2% and the total earned cashback is capped at Rs 1,000 for online in every bill cycle.

6. Cashback from OFFLINE spends is 1% and the total earned cashback is capped at Rs 500 for offline in every bill cycle.

7. So, the maximum possible Cashback that can be earned is Rs 1,500 in every bill cycle and Rs 18,000 in 1 year !

Below mentioned transaction types are eligible for cashback.

1. All Types Of Shopping Purchases

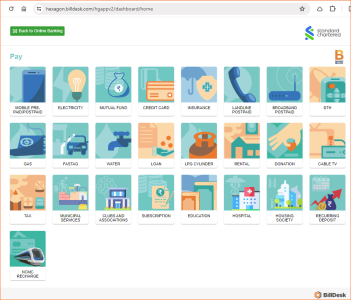

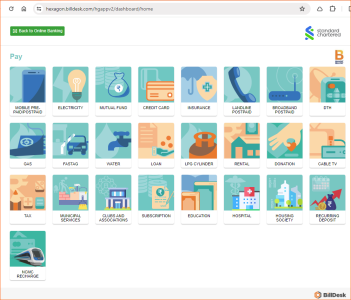

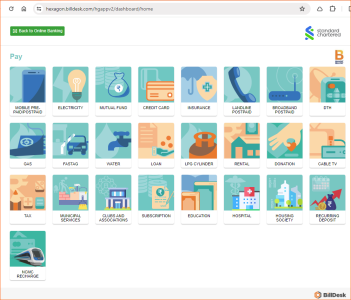

2. Telecom Prepaid and Postpaid Payments (Eligible only if Paid using SMART PAY which is internal biller of SC)

3. Utilities (For Electricity, Water, Gas Only) (Eligible only if Paid using SMART PAY which is internal biller of SC). No Other Utilities Allowed for cashback !

3. All Types of Insurance and Mediclaim Premium Payments

5. Pharmacy and Hospital Bill Payments

6. Gold Purchase (this is true as I tested this, and I got the cashback too)

7. Government Bill Payments

8. Education Bill Payments

All the above cashback categories are true as I have done all the above types of transaction in my 3 months of usage.

I have received the cashback on all of them, especially Gold purchase which is never given by any other banks !

Though, if you ask on customer care, their executives may deny you for Gold purchase, which I faced it, but received the cashback for that too, LOL !!!

No Cashbacks In:

1. Fuel

2. Rental

3. Wallet Loading

4. Cash Withdrawals and Transfers

Other Benefits:

1. EMI available on all transactions starting from Rs 2,500

2. First 3 Months of Interest free credit if we pay only the minimum credit card bill amount. These unpaid 3 months amount needs to be paid on the fourth credit card statement. Otherwise, interest is applied with penalty. The minimum credit card bill amount is 5% of the total unpaid spends.

No Other Benefits and Conditions are applicable, other than all mentioned above !!! (in context to points mentioned above)

Minor Cons:

1. Their Technology are not real-time all the time. Because, sometimes their Transaction notification emails are delayed by 2 days.

2. The earned cashbacks takes upto 5 Working days to get reflected in their rewards portal and redemption also takes same duration.

Refer the below or the attached images too.

All details are as of 31-Mar-2024.

No assurance about future changes !

But I asked the bank, from when these all benefits started, they mentioned approximately from last 2 Years !

So, I hope the same benefit may continue atleast for next 2 to 3 years.

*** All Explained by PIX789

4 Images goes here:

Credit Card Look:

SC Internal Biller SmartPay Page:

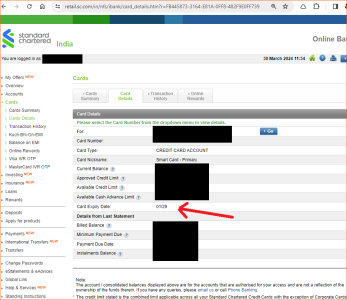

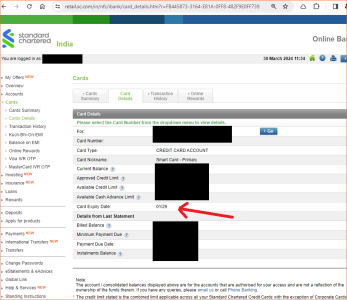

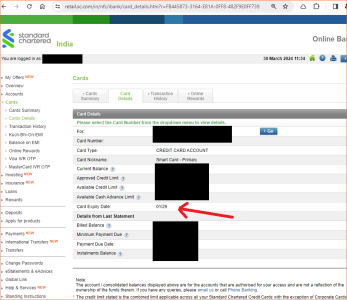

My Start Month Proof Page: (validity is always of 5 years!)

My Cashback Proof Page:

*** END ***

Writing this post truly based on my Personal Experience, after using this credit card for 3 months.

I have used many cards until now, but this card has given me the true benefits of holding a credit card.

These benefits are very simple in understanding and can be evaluated without any complexity.

As of 31-Mar-2024,

I believe that, the Best Cashback Credit Card For 2024 is Standard Chartered Smart Visa Platinum Credit Card !!!

Though, this card has a joining and renewal fees of Rs 499 + GST but the cashback is too good.

Renewal fees are waved off, if we spend more than Rs 1,20,000 in a year !

Cashback Details:

1. Cashback redemption is allowed at a minimum of Rs 1000 and then in multiples of Rs 500 thereafter, with ZERO redemption fees.

2. Cashback is adjusted in the next credit card statement.

3. Cashback is available on its internal Reward Portal.

4. Cashback is eligible on a minimum transaction of Rupee One

5. Cashback from ONLINE spends is 2% and the total earned cashback is capped at Rs 1,000 for online in every bill cycle.

6. Cashback from OFFLINE spends is 1% and the total earned cashback is capped at Rs 500 for offline in every bill cycle.

7. So, the maximum possible Cashback that can be earned is Rs 1,500 in every bill cycle and Rs 18,000 in 1 year !

Below mentioned transaction types are eligible for cashback.

1. All Types Of Shopping Purchases

2. Telecom Prepaid and Postpaid Payments (Eligible only if Paid using SMART PAY which is internal biller of SC)

3. Utilities (For Electricity, Water, Gas Only) (Eligible only if Paid using SMART PAY which is internal biller of SC). No Other Utilities Allowed for cashback !

3. All Types of Insurance and Mediclaim Premium Payments

5. Pharmacy and Hospital Bill Payments

6. Gold Purchase (this is true as I tested this, and I got the cashback too)

7. Government Bill Payments

8. Education Bill Payments

All the above cashback categories are true as I have done all the above types of transaction in my 3 months of usage.

I have received the cashback on all of them, especially Gold purchase which is never given by any other banks !

Though, if you ask on customer care, their executives may deny you for Gold purchase, which I faced it, but received the cashback for that too, LOL !!!

No Cashbacks In:

1. Fuel

2. Rental

3. Wallet Loading

4. Cash Withdrawals and Transfers

Other Benefits:

1. EMI available on all transactions starting from Rs 2,500

2. First 3 Months of Interest free credit if we pay only the minimum credit card bill amount. These unpaid 3 months amount needs to be paid on the fourth credit card statement. Otherwise, interest is applied with penalty. The minimum credit card bill amount is 5% of the total unpaid spends.

No Other Benefits and Conditions are applicable, other than all mentioned above !!! (in context to points mentioned above)

Minor Cons:

1. Their Technology are not real-time all the time. Because, sometimes their Transaction notification emails are delayed by 2 days.

2. The earned cashbacks takes upto 5 Working days to get reflected in their rewards portal and redemption also takes same duration.

Refer the below or the attached images too.

All details are as of 31-Mar-2024.

No assurance about future changes !

But I asked the bank, from when these all benefits started, they mentioned approximately from last 2 Years !

So, I hope the same benefit may continue atleast for next 2 to 3 years.

*** All Explained by PIX789

4 Images goes here:

Credit Card Look:

SC Internal Biller SmartPay Page:

My Start Month Proof Page: (validity is always of 5 years!)

My Cashback Proof Page:

*** END ***

Attachments

Last edited: