You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Fd Backed CC

- Thread starter asfak7850

- Start date

-

- Tags

- fd based credit card

thefiscalalchemist

KF Ace

Here are a few options I know which provides FD based credit card:

1. Supercard by Supermoney app - It does not have any annual fees and provides 0.5% on Rupay card UPI transaction. You can also get cashbacks on partnered brands like Flipkart, Myntra etc. Minimum FD required is 5k.

2. One Card - It does not have any annual fees. Minimum FD required is 5k.

3. Simplifi card by Fi - It does not have any annual fees. Minimum FD required is 15k.

3. First wow credit card by IDFC Bank- Joining fee of ₹199 + GST and Annual fee (2nd year onwards) of ₹199 + GST. Minimum FD 20K.

4. ICICI Platinum credit card - Minimum FD requirement is 50K.

Nowadays some other banks like AU Small Finance and HDFC are also offering FD Based credit card. For a new bee, I would recommend going for Super card for its simplicity in managing and rewards on UPI.

1. Supercard by Supermoney app - It does not have any annual fees and provides 0.5% on Rupay card UPI transaction. You can also get cashbacks on partnered brands like Flipkart, Myntra etc. Minimum FD required is 5k.

2. One Card - It does not have any annual fees. Minimum FD required is 5k.

3. Simplifi card by Fi - It does not have any annual fees. Minimum FD required is 15k.

3. First wow credit card by IDFC Bank- Joining fee of ₹199 + GST and Annual fee (2nd year onwards) of ₹199 + GST. Minimum FD 20K.

4. ICICI Platinum credit card - Minimum FD requirement is 50K.

Nowadays some other banks like AU Small Finance and HDFC are also offering FD Based credit card. For a new bee, I would recommend going for Super card for its simplicity in managing and rewards on UPI.

TaxWiser

KF Mentor

Apart from Secured CC, if your primary objective is to build Credit Score then consider opening Amazon Pay Later or any Pay Later account. Use less than 25% of the sanctioned Pay Later limit and pay the TAD atleast 5 days before Due Date.Currently I have -1 credit score I just finding way for beginning the journey of cibil now so I thought to start with fd backed CC suggest me best one with fd starting 5k . And tell me which can be other method for building first ever cibil score

This is how I started building my Credit Score and after 9 months I got my first Pre-approved LTF CC then I Closed my Amazon Pay Later account permanently.

zacobite

KF Mentor

Supercard for nowHere are a few options I know which provides FD based credit card:

1. Supercard by Supermoney app - It does not have any annual fees and provides 0.5% on Rupay card UPI transaction. You can also get cashbacks on partnered brands like Flipkart, Myntra etc. Minimum FD required is 5k.

2. One Card - It does not have any annual fees. Minimum FD required is 5k.

3. Simplifi card by Fi - It does not have any annual fees. Minimum FD required is 15k.

3. First wow credit card by IDFC Bank- Joining fee of ₹199 + GST and Annual fee (2nd year onwards) of ₹199 + GST. Minimum FD 20K.

4. ICICI Platinum credit card - Minimum FD requirement is 50K.

Nowadays some other banks like AU Small Finance and HDFC are also offering FD Based credit card. For a new bee, I would recommend going for Super card for its simplicity in managing and rewards on UPI.

WOW is gd.. especially if u have forex txn

krishna1718

KF Mentor

IDFC FIRST EARN Credit Card Best Rupay credit with no cashback rescritions every month statement auto credit if you are heavy rupay user its best card though its chargeable you can have best experience

What if i am not eligible for any pay later account what can be a good option to build a better credit score with use of credit mix if it could be benefitedApart from Secured CC, if your primary objective is to build Credit Score then consider opening Amazon Pay Later or any Pay Later account. Use less than 25% of the sanctioned Pay Later limit and pay the TAD atleast 5 days before Due Date.

This is how I started building my Credit Score and after 9 months I got my first Pre-approved LTF CC then I Closed my Amazon Pay Later account permanently.

Is onecard issues cards without any waitlistHere are a few options I know which provides FD based credit card:

1. Supercard by Supermoney app - It does not have any annual fees and provides 0.5% on Rupay card UPI transaction. You can also get cashbacks on partnered brands like Flipkart, Myntra etc. Minimum FD required is 5k.

2. One Card - It does not have any annual fees. Minimum FD required is 5k.

3. Simplifi card by Fi - It does not have any annual fees. Minimum FD required is 15k.

3. First wow credit card by IDFC Bank- Joining fee of ₹199 + GST and Annual fee (2nd year onwards) of ₹199 + GST. Minimum FD 20K.

4. ICICI Platinum credit card - Minimum FD requirement is 50K.

Nowadays some other banks like AU Small Finance and HDFC are also offering FD Based credit card. For a new bee, I would recommend going for Super card for its simplicity in managing and rewards on UPI.

I need a LTF CC Which Can generate Credit score and I don’t have to close it in future termsIDFC FIRST EARN Credit Card Best Rupay credit with no cashback rescritions every month statement auto credit if you are heavy rupay user its best card though its chargeable you can have best experience

krishna1718

KF Mentor

It showing as secured from last month to all just to improve cibil you can get it go with 500-1000 fd enough for that card you won't get any benefits but decent lifetime free cardWith your experience can anyone tell me about super money card is it shows secured on CIBIL or unsecured and can it be a good option for a cibil generation also how much time it would take to update to credit bureaus

Minimum FD required is just 100rsSupercard by Supermoney app - It does not have any annual fees and provides 0.5% on Rupay card UPI transaction. You can also get cashbacks on partnered brands like Flipkart, Myntra etc. Minimum FD required is 5k.

I was thinking to do 5K fd so that i can get physical card without additional cost. Also what is your thought upon kredit.pe SBM bank Card is it worthy or not ?Minimum FD required is just 100rs

kedarjoshi

KF Ace

I am currently using Kredit.Pe which provides FD backed credit card with SBM Bank. It gives 2% cashback on UPI payments and 3% cashback on offline payments. So far so good. Do check it out.

But that cashback doesn’t credit on statement you can just get some discount on buying gift card using that cashback also 1% redeem fees also impose on discountI am currently using Kredit.Pe which provides FD backed credit card with SBM Bank. It gives 2% cashback on UPI payments and 3% cashback on offline payments. So far so good. Do check it out.

I am currently using Kredit.Pe which provides FD backed credit card with SBM Bank. It gives 2% cashback on UPI payments and 3% cashback on offline payments. So far so good. Do check it out.

@asfak7850

Yes, I agree on Kredit.Pe

It is FD based as low as 2000/-

90% will be the limit of the FD amount.

This can be tried.

But what about its reward structure? Is it worthy?@asfak7850

Yes, I agree on Kredit.Pe

It is FD based as low as 2000/-

90% will be the limit of the FD amount.

This can be tried.

If award structure is also a concern then you may try for HDFC Tata Neu FD based card.But what about its reward structure? Is it worthy?

I am now sure what are the minimum deposit requirement but with rupay Neu plus you will get 1% thru tata neu app and for neu infinity you will get 1.5% thru tata neu app.

its minimum fd requirement is 15k..If award structure is also a concern then you may try for HDFC Tata Neu FD based card.

I am now sure what are the minimum deposit requirement but with rupay Neu plus you will get 1% thru tata neu app and for neu infinity you will get 1.5% thru tata neu app.

Akusahil

KF Expert

(Those who don't know super Credit card)With your experience can anyone tell me about super money card is it shows secured on CIBIL or unsecured and can it be a good option for a cibil generation also how much time it would take to update to credit bureaus

SuperMoney Credit card is FD(Fixed Deposit) based Credit card in other words it's Credit card against your fixed deposit. It provided by Utkarsha Small Finance Bank partnership with SuperMoney by Flipkart. Main advantage of this card is that your FD start with just 100rs and you'll get Virtual Credit with limit 90% of your fixed deposit. Wanna Physical Card then you need to create FD with minimum 5000rs.

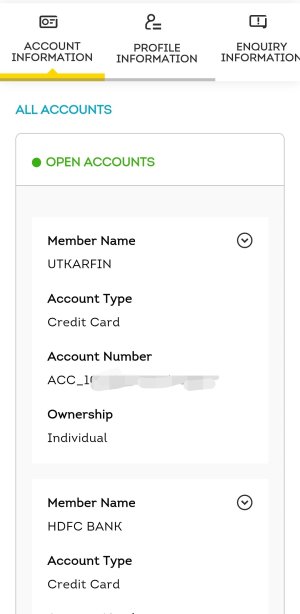

I was shocked when I saw my Cibil Report!

2 Months back I have applied for SuperMoney Credit Card for keeping as FD based Credit Card in portfolio but In my cibil report it shows As Credit Card instead of Secured Credit Card. I don't how?

So be aware that if you are applying Super Money Credit as FD Based Credit card to improve your score, it won't work.

Attachments

krishna1718

KF Mentor

They will update to secured in 1-2 months don't worry about it(Those who don't know super Credit card)

SuperMoney Credit card is FD(Fixed Deposit) based Credit card in other words it's Credit card against your fixed deposit. It provided by Utkarsha Small Finance Bank partnership with SuperMoney by Flipkart. Main advantage of this card is that your FD start with just 100rs and you'll get Virtual Credit with limit 90% of your fixed deposit. Wanna Physical Card then you need to create FD with minimum 5000rs.

I was shocked when I saw my Cibil Report!

2 Months back I have applied for SuperMoney Credit Card for keeping as FD based Credit Card in portfolio but In my cibil report it shows As Credit Card instead of Secured Credit Card. I don't how?

So be aware that if you are applying Super Money Credit as FD Based Credit card to improve your score, it won't work.