You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

best zero balance saving account

- Thread starter iconic

- Start date

Mdzainal199

KF Rookie

Dear Member,

Thank you for reaching us.

As I see you have already options like SBI, Kotak, BOB, PNB. I'll suggest you to open a Zero Balance Account in Kotak Mahindra Bank. It is basically Kotak 811 service for Zero Balance Account. Also you will find all other services in the tip of your hand. Apart from this, other private banks will definitely ask you to maintain a minimum balance all the time..

Hoping to get a positive reply from your end.

Thank you.

Thank you for reaching us.

As I see you have already options like SBI, Kotak, BOB, PNB. I'll suggest you to open a Zero Balance Account in Kotak Mahindra Bank. It is basically Kotak 811 service for Zero Balance Account. Also you will find all other services in the tip of your hand. Apart from this, other private banks will definitely ask you to maintain a minimum balance all the time..

Hoping to get a positive reply from your end.

Thank you.

Akusahil

KF Expert

Best zero balance savings account ever is IDFC Future Future First Account, for this you don't need to have enrolled in premier institution just check your college name in the list( idfc first bank have list of most of all colleges) if it is, then you can open this account. You can only open this account by visiting bank it's fully digitally account.This will be coming to be my first bank acc. I have few options like Icici, sbi, kotak, bob, pnb. But im soo confused. You can also suggest any other.

Can you guys suggest me which on would be the best.

I mostly manage things online. but also want decent service.

(All service charges are free,physical debit is also free)

Second account I would prefer Kotak811, at this time you can open this bank offline only.

There are lot charge while operating this account, so be careful.

Third account is Canara Aspire Savings account, in this account there aare .ost of services are free including debit card charges ( till age of 28) after this you'll charge debit card fees

Fourth bank I would prefer SBI Instaplus Saving account , if you can then open this bank online only don't visit sbi branch

Last edited:

Best zero balance savings account ever is IDFC Future Future First Account, for this you don't need to have enrolled in premier institution just check your college name in the list( idfc first bank have list of most of all colleges) if it is, then you can open this account. You can only open this account by visiting bank it's fully digitally account.

(All service charges are free,physical debit is also free)

Second account I would prefer Kotak811, at this time you can open this bank offline only.

There are lot charge while operating this account, so be careful.

Third account is Canara Aspire Savings account, in this account there aare .ost of services are free including debit card charges ( till age of 28) after this you'll charge debit card fees

Fourth bank I would prefer SBI Instaplus Saving account , if you can then open this bank online only don't visit sbi branch

thankyou

but there is no branch of idfc in my city

but have kotak branch

can you help me by explaining charging of kotak 811

ak@bekifaayati

KF Rookie

If icici bank is providing zero balance account, then go for it. One of the best bank in India. The UI of icici Mobile app is best than any other bankThis will be coming to be my first bank acc. I have few options like Icici, sbi, kotak, bob, pnb. But im soo confused. You can also suggest any other.

Can you guys suggest me which on would be the best.

I mostly manage things online. but also want decent service.

Akusahil

KF Expert

I wish I could, from starting when I was opened my first account (when i was turned to 18) from that time till now I am trying to open a zero balance or regular saving account in ICICI, but the employees are denying me to open a zero balance, and they are demanding 1lac Rs check as initial deposit for opening a regular saving account, but got best open that is open digital youth saving account in HDFC this not zero balance(5000rs MAB) I am operating this as my primary account.If icici bank is providing zero balance account, then go for it. One of the best bank in India. The UI of icici Mobile app is best than any other bank

you can try or ask to the employe for opening a zero-balance account in ICICI.

Akusahil

KF Expert

There are no charges if you are using Kotak811 account wisely.thankyou

but there is no branch of idfc in my city

but have kotak branch

can you help me by explaining charging of kotak 811

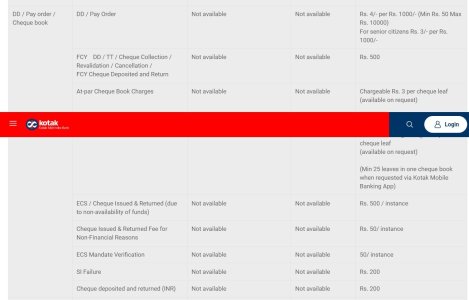

still their charges as

-Physical debit charges 299(inclusive charges)

-Physical passbook will not issued

below charges are important to keep in mind

you can operate this account without charges, just don't visit branch for cash transaction related services.

Attachments

Md Tasneem

KF Rookie

But i think due to rbi ban kotak has stopped 0 balance account because they can't onboard new customers onlineDear Member,

Thank you for reaching us.

As I see you have already options like SBI, Kotak, BOB, PNB. I'll suggest you to open a Zero Balance Account in Kotak Mahindra Bank. It is basically Kotak 811 service for Zero Balance Account. Also you will find all other services in the tip of your hand. Apart from this, other private banks will definitely ask you to maintain a minimum balance all the time..

Hoping to get a positive reply from your end.

Thank you.

Akusahil

KF Expert

Yeah it's true!But i think due to rbi ban kotak has stopped 0 balance account because they can't onboard new customers online

But, you can open zero balance account by visiting kotak branch. It can be open offline only.

Md Tasneem

KF Rookie

Did you open this account offline?Yeah it's true!

But, you can open zero balance account by visiting kotak branch. It can be open offline only.

Akusahil

KF Expert

Yes!

Also I recommended my friends and they I have opened this account. But while opening the account employee will ask to initial deposit of 1000rs, do that. Also after opening the account it will take about 8hours to activate account but in my case account is activated in 4 hours.

Also I recommended my friends and they I have opened this account. But while opening the account employee will ask to initial deposit of 1000rs, do that. Also after opening the account it will take about 8hours to activate account but in my case account is activated in 4 hours.

Md Tasneem

KF Rookie

Is there any sms chargers or any hidden charges

So use au small finance bank accountBut i think due to rbi ban kotak has stopped 0 balance account because they can't onboard new customers online

Call/visit kotak, they might come to your home to open the account.

Try to open zero balance 811 "super" account. It is little higher version of 811 account.

811 super is also zero balance account.

It has a fee of 300/- per year and you will get physical debit card (included) and cheque book and higher withdrawal limit.

It is also providing 5% cashback upto 500/- i.e. on spends of up to 10K per month. You would need to check for exclusions though.

You would need to add 5K every month to be eligible for getting cashback on your spends

Try to open zero balance 811 "super" account. It is little higher version of 811 account.

811 super is also zero balance account.

It has a fee of 300/- per year and you will get physical debit card (included) and cheque book and higher withdrawal limit.

It is also providing 5% cashback upto 500/- i.e. on spends of up to 10K per month. You would need to check for exclusions though.

You would need to add 5K every month to be eligible for getting cashback on your spends

Md Tasneem

KF Rookie

But au doesn't offers virtual debit card I don't want to pay physical card chargesSo use au small finance bank account

Similar threads

- Replies

- 15

- Views

- 862

- Replies

- 2

- Views

- 212

- Replies

- 2

- Views

- 218

- Replies

- 9

- Views

- 1K