I have applied for BOB CREDIT CARD (VKYC remaining).

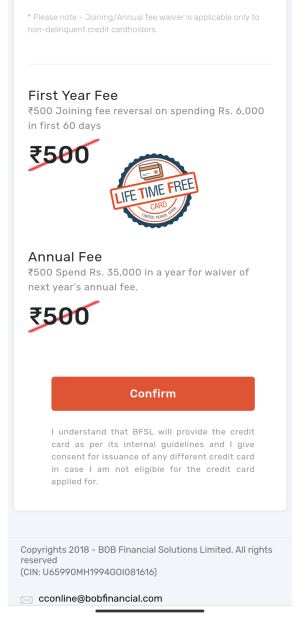

It's was written LTF on the page(image attached for reference).

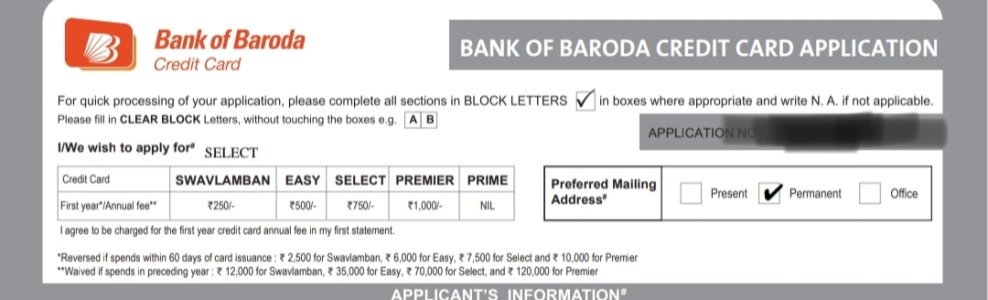

I got option to choose between EASY VS SELECT. I opted for SELECT. Idk know the benefits of this .

.

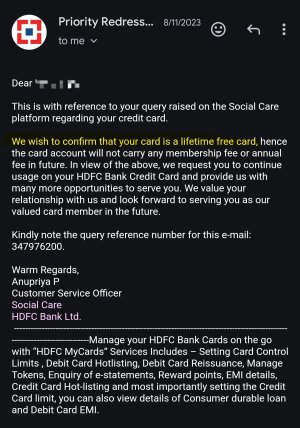

I want to confirm that it will be lifetime free or there is any catch, should I have to spend the required spend limit.

It's was written LTF on the page(image attached for reference).

I got option to choose between EASY VS SELECT. I opted for SELECT. Idk know the benefits of this

I want to confirm that it will be lifetime free or there is any catch, should I have to spend the required spend limit.