You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

commission or brokerage income

- Thread starter rajib

- Start date

TaxWiser

KF Mentor

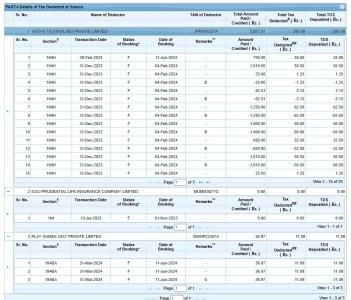

I earned nearly 6000 commission from an app for sharing credit card. Which is paying me commission after deducting TDS u/s 194H. Now in my AIS its showing as commission income. Please guide me in which schedule I can fill this for my tax filling. I am filling ITR3 new tax regime.

Hey buddy! For your commission income, you'll need to report it under the "Profit and Gains from Business or Profession" section in ITR-3. Here’s a quick guide:

1. Schedule BP (Business or Profession): Enter your commission income here.

2. Schedule TDS: Make sure to include the TDS details deducted under Section 194H.

Since you're filing under the new tax regime, you won't be able to claim certain deductions, but you can still report your income accurately.

TaxWiser

KF Mentor

Fill and verify your data in following orderin which section I have to file for these 5958 amounts? There is also a winning from games amount of 37. It showing I have to pay 11 as a tax slab of 30% in games winning. Can you guide please for this.

For Commission Income:

Nature of Business (Business Name - PAN name, Business Code - 21008 Other services n.e.c., Description- Commission Income) -> Part A Balance Sheet -> Part A P&L -> Shedule BP

For Income from Online games:

Shedule Income from Other Sources -> 2.Income chargeable at Special Rates -> 10. Information about accrual/receipt of income from Other Sources (Must fill amount earned in respective Quaters) -> 1(ii).Income by way of winnings from online games u/s 115BBJ

This the best I can help you with, For video demo, try watching FinTaxPro, CA Sumit sharma, MyOnlineCA YouTube videos regarding the same.

thanks a lot...Fill and verify your data in following order

For Commission Income:

Nature of Business (Business Name - PAN name, Business Code - 21008 Other services n.e.c., Description- Commission Income) -> Part A Balance Sheet -> Part A P&L -> Shedule BP

For Income from Online games:

Shedule Income from Other Sources -> 2.Income chargeable at Special Rates -> 10. Information about accrual/receipt of income from Other Sources (Must fill amount earned in respective Quaters) -> 1(ii).Income by way of winnings from online games u/s 115BBJ

This the best I can help you with, For video demo, try watching FinTaxPro, CA Sumit sharma, MyOnlineCA YouTube videos regarding the same.

Similar threads

- Replies

- 0

- Views

- 229

- Replies

- 0

- Views

- 230

- Replies

- 0

- Views

- 188