shreypatel91

KF Rookie

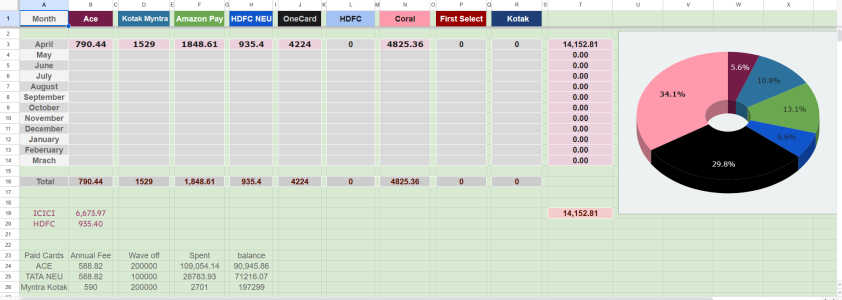

As per income tax notice on credit card above 10 lacs spends in a

1. INDIAN FINANCIAL YEAR ??

2. I HAVE 2-3 CARDS 10 LACS TOTAL AMOUNT OF ALL CARDS TRANSACTION

1. INDIAN FINANCIAL YEAR ??

2. I HAVE 2-3 CARDS 10 LACS TOTAL AMOUNT OF ALL CARDS TRANSACTION