Hi All,

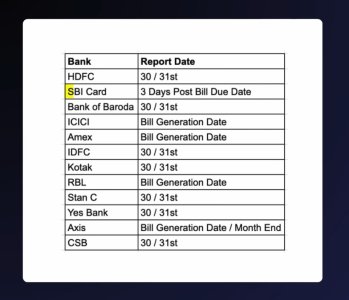

To maximise your Credit Score, your Credit Utilization must be kept below 30%. For this we should know on which date your Card Issuer/ Bank sends monthly reports to Credit Bureau (CIBIL, Experian, etc) so that we can clear our CC Outstanding before this date..

Sharing this data for a Couple of Card Issuers that I know of

HDFC Bank - End of Month (30/ 31st)

SBI Cards- 3 Days Post Bill Due Date

Please keep adding data for Other Credit Cards

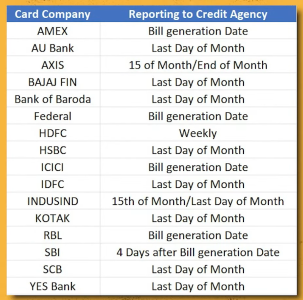

To maximise your Credit Score, your Credit Utilization must be kept below 30%. For this we should know on which date your Card Issuer/ Bank sends monthly reports to Credit Bureau (CIBIL, Experian, etc) so that we can clear our CC Outstanding before this date..

Sharing this data for a Couple of Card Issuers that I know of

HDFC Bank - End of Month (30/ 31st)

SBI Cards- 3 Days Post Bill Due Date

Please keep adding data for Other Credit Cards