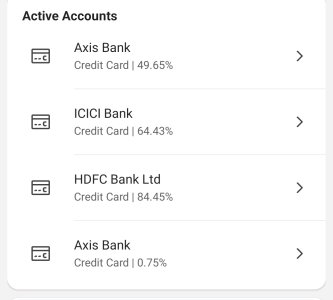

Senerio 1: I have Icici credit card all are LTF cards (1Apay,1visa platinum,1rupay coral). Rupay coral is of no use for me and I also don't know the benefits. Initially when I use rupay coral its has UPI failure most of time. I avoid using it. I use sbi simply save and tata neu for UPI.

Q1. I want t close my ICICI rupay Coral card is it will be good decision.

Q2 How much max card ICICI offer at one time.

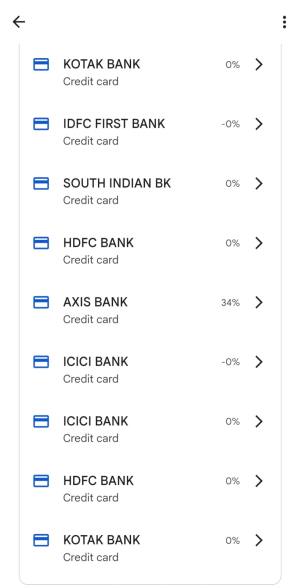

Q3. In my cibil(Equifax) I found 1entry for my all icici card as all are in sharing limit. Will it impact my cibil, if yes then by how much.

Senerio 2:

I have 2 Axis Bank credit card:

1 Flipkart Axis 2nd axis (LTF)neo.

I am planning to close my Flipkart as it's fee reversal is on 3.5 lakh.. I am currently at 2.2lakh but it can't be achieved for when you have multiple card.

But as per my cibil Axis is mentioned 2times but the limit is shared between them.

I am planning to close Flipkart card because I have Amazon card and prime. Flipkart card is worst everywhere other than Flipkart. It takes so long for the cashback when you forget about that.

If I got Convert into LTF then I will put in my purse ideally with minimal use or no use.( Any method to convert in LTF)

Just I am confused with 2senerio should I close this after specific time intervals.

1st Flipkart and after 6month ICICI .

As Flipkart card is marked in cibil and neo is also marked in cibil seperately how it will impact cibil by how much points.

Just a genuine suggestion needed.

Q1. I want t close my ICICI rupay Coral card is it will be good decision.

Q2 How much max card ICICI offer at one time.

Q3. In my cibil(Equifax) I found 1entry for my all icici card as all are in sharing limit. Will it impact my cibil, if yes then by how much.

Senerio 2:

I have 2 Axis Bank credit card:

1 Flipkart Axis 2nd axis (LTF)neo.

I am planning to close my Flipkart as it's fee reversal is on 3.5 lakh.. I am currently at 2.2lakh but it can't be achieved for when you have multiple card.

But as per my cibil Axis is mentioned 2times but the limit is shared between them.

I am planning to close Flipkart card because I have Amazon card and prime. Flipkart card is worst everywhere other than Flipkart. It takes so long for the cashback when you forget about that.

If I got Convert into LTF then I will put in my purse ideally with minimal use or no use.( Any method to convert in LTF)

Just I am confused with 2senerio should I close this after specific time intervals.

1st Flipkart and after 6month ICICI .

As Flipkart card is marked in cibil and neo is also marked in cibil seperately how it will impact cibil by how much points.

Just a genuine suggestion needed.