soumen Das

KF Expert

How about IDFC SWYP Credit Card?

Will the credit card be good?

Will the credit card be good?

Card review: Sab hai dikhave, Jhoothe behlaave. Ek hi kadam laaye sou sou pachhtaave.How about IDFC SWYP Credit Card?

Will the credit card be good?

HmmCard review: Sab hai dikhave, Jhoothe behlaave. Ek hi kadam laaye sou sou pachhtaave.

View attachment 1589

5000 spend - 200*0.25 = 50 (1%)

10000 spend - 500*0.25 = 100 (1%)

15000 spend - 10000*0.25 = 150 (1%)

And to redeem those rewards you need to pay 117.82/- (99+18% GST)

So, return for

5k spend = -67.82/- (-1.36%)

10k spend = -17.82/- (-0.178%)

15k spend = 32.18/- (0.214%)

.

- Monthly here means customer’s credit card billing cycle, Reward Points will be credited on statement date

- Milestone rewards are not incremental; for e.g. On an eligible spend of ₹16,000, Customer will earn 1,000 Rewards Points only

- Monthly Milestone Rewards not applicable on Rental^, Cash Withdrawal, Fuel & Utility transactions

- ^400 Reward Points on minimum spends of ₹20,000 Rental and Utility spends per billing cycle

-1 Reward Point = ₹0.25

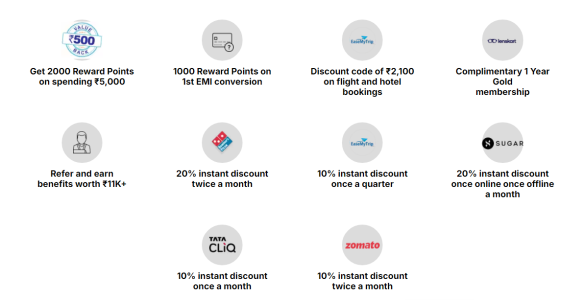

View attachment 1590

- 10% Discount twice a month on Zomanto

- 10% Discount Once a month on Tata Cliq

I would not even recommed getting card for this as this is a paid card with 588.82/- annual fee.

Instead of SWYP you can go for select or millennia (as per your eligibility)How about IDFC SWYP Credit Card?

Will the credit card be good?

Yes, better to get the LTF cards instead but there are not non spend based rewards nowInstead of SWYP you can go for select or millennia (as per your eligibility)

Coz they are LTF and paying 500+gst is not worth it for swyp (benefits are less)

And in my opinion all cards of IDFC first are good in non-spend benefits coz it comes with a lot of benefits

I got First Business Card where i received Dreamfolks membership and card worth 99$ which gives access to national/international lounge 2 for me 2 for my guests / Quarterly (Since its a membership so i don’t need to meet any spending criteria) Card FEE -500+gstYes, better to get the LTF cards instead but there are not non spend based rewards now

Lounge acsess 20k month to avail it.