I have credit limit of 50 k . icici bank credit card ... i want to purchase one item of 30 k... on emi ..of 12*2.k so in cibil credit utilization will be based on 2.5 k or 30 k ?? i tracked .my credit utilization is based on bill generation ..! so will it be 2.k ...or 30 k ??

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CREDIT CARD UTILISATION

- Thread starter Nikhil416

- Start date

Skylar

KF Master

2.5KI have credit limit of 50 k . icici bank credit card ... i want to purchase one item of 30 k... on emi ..of 12*2.k so in cibil credit utilization will be based on 2.5 k or 30 k ?? i tracked .my credit utilization is based on bill generation ..! so will it be 2.k ...or 30 k ??

Several months back, I had an item on EMI, and ICICI Bank reported the EMI balance as the spending for that month.

nirmal1410

KF Rookie

Yes it will show the EMI as utilisation and to avoid credit utilisation issue better opt for other credit cards so it will calculate the total limit of all with utilisation of all cards, by that you can use the cards hassle free without thinking much of utilisation.

TaxWiser

KF Mentor

30KI have credit limit of 50 k . icici bank credit card ... i want to purchase one item of 30 k... on emi ..of 12*2.k so in cibil credit utilization will be based on 2.5 k or 30 k ?? i tracked .my credit utilization is based on bill generation ..! so will it be 2.k ...or 30 k ??

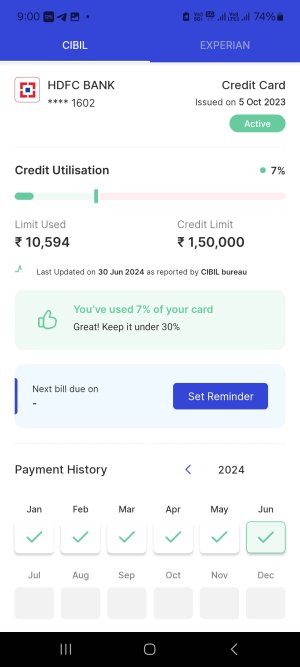

I myself was not sure but today I am. Last month, I used my CC to make a No Cost EMI purchase of ₹9749 & for paying utility bills. As you can see in my latest CIBIL report refreshed today that the total Spend amount (Total Purchase amt. + Processing fees + GST + Other spends) is showing instead of monthly EMI.

Last edited:

Skylar

KF Master

- Purchase date?30K

I myself was not sure but today I am. Last month, I used my CC to make a No Cost EMI purchase of ₹9749 & for paying utility bills. As you can see in my latest CIBIL report refreshed today that the total Spend amount (Total Purchase amt. + Processing fees + GST + Other spends) is showing instead of monthly EMI. View attachment 1277

TaxWiser

KF Mentor

9th June- Purchase date?

Skylar

KF Master

It would be changed to EMI amount after billing date. That is what happened with my ICICI Card.9th June

TaxWiser

KF Mentor

30K

I myself was not sure but today I am. Last month, I used my CC to make a No Cost EMI purchase of ₹9749 & for paying utility bills. As you can see in my latest CIBIL report refreshed today that the total Spend amount (Total Purchase amt. + Processing fees + GST + Other spends) is showing instead of monthly EMI. View attachment 1277

I have credit limit of 50 k . icici bank credit card ... i want to purchase one item of 30 k... on emi ..of 12*2.k so in cibil credit utilization will be based on 2.5 k or 30 k ?? i tracked .my credit utilization is based on bill generation ..! so will it be 2.k ...or 30 k ??

Correct Answers depends on whether the bank has converted the total utilized amount into EMI before Billing Date of your CC.

credit:

It would be changed to EMI amount after billing date. That is what happened with my ICICI Card.

Your CIBIL credit utilization will be based on the outstanding balance reported on your credit card statement, not the EMI amount.

So, in this case, it would likely be based on the full purchase amount of ₹30,000.

Here's why:

CIBIL considers your credit limit and the outstanding balance on your card at the statement generation date to calculate your credit utilization ratio.

This ratio reflects the percentage of your credit limit you're currently using.

For credit reporting purposes, the entire purchase amount is typically reflected as outstanding balance on your credit card statement until it's fully paid off.

Here's the calculation for your credit utilization ratio if the outstanding balance is ₹30,000 and your credit limit is ₹50,000:

Credit Utilization Ratio = (Outstanding Balance / Credit Limit) x 100

= (₹30,000 / ₹50,000) x 100

= 60%

A high credit utilization ratio (below 30% is generally considered ideal) can negatively impact your credit score.

It's better to discuss with your bank and increase credit limit then u can purchase , so credit utilization ratio comes below 30%

So, in this case, it would likely be based on the full purchase amount of ₹30,000.

Here's why:

CIBIL considers your credit limit and the outstanding balance on your card at the statement generation date to calculate your credit utilization ratio.

This ratio reflects the percentage of your credit limit you're currently using.

For credit reporting purposes, the entire purchase amount is typically reflected as outstanding balance on your credit card statement until it's fully paid off.

Here's the calculation for your credit utilization ratio if the outstanding balance is ₹30,000 and your credit limit is ₹50,000:

Credit Utilization Ratio = (Outstanding Balance / Credit Limit) x 100

= (₹30,000 / ₹50,000) x 100

= 60%

A high credit utilization ratio (below 30% is generally considered ideal) can negatively impact your credit score.

It's better to discuss with your bank and increase credit limit then u can purchase , so credit utilization ratio comes below 30%

Similar threads

- Replies

- 1

- Views

- 78

- Replies

- 3

- Views

- 183

- Replies

- 2

- Views

- 268