ask_utkarsh

KF Ace

If i have 4 credit cards, then do i need to use all them in every month.

Not using any two of them, does it hurt my credit score ??

Not using any two of them, does it hurt my credit score ??

Nope, Using all card isn't necessary, Credit Score depends on Overall Credit Utilization instead of Individual Credit card Utilization but it's advisable to use every CC atleast once every 6 months to avoid any inconvineance in future.If i have 4 credit cards, then do i need to use all them in every month.

Not using any two of them, does it hurt my credit score ??

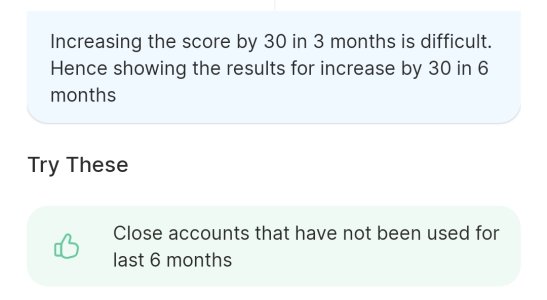

I think its first individual card limit utilisation which is more crucial than over all limits combined for miltiple cards . Caz this had impacted me a lil and reduced 10 cibil points for meNope, Using all card isn't necessary, Credit Score depends on Overall Credit Utilization instead of Individual Credit card Utilization but it's advisable to use every CC atleast once every 6 months to avoid any inconvineance in future.

View attachment 1860

I think its first individual card limit utilisation which is more crucial than over all limits combined for miltiple cards . Caz this had impacted me a lil and reduced 10 cibil points for me

I have multiple cards and over all limits combined of all cards was about 19l.

However i utilised only hdfc card in that bill cycle above 1 lac of 3.2lac card limit i agree i used more than 30% of utilisation ratio. Caz i too had same logic over all it was less than 5% of total credit limit.

And bill was paid in timely manner without any delay however it did impact my cibil score by 10 points .

Thanks for the video have already been through it .Reason for -10 in your cibil score:

View attachment 1862

I only use my One Card CC twice or thrice in a year and still doesn't notice any significant changes in my cibil because of it.

But it's advisable to use atleast 1% of every CC and make sure your overall credit utilization remain always <30% if you don't find the before mentioned information authentic

For better understanding watch this video:

ThanksAs I can notice in the screenshot, their are 2 fields where you can improve:

PS: This are some Recommendations/Observations based on my personal experiences, I'm not a Credit Score Guru

- Make Credit Utilization between 3-7%

- Improve Credit Mix

I just noticed one more thing so my total limit on cibil stands at 21.08 however i have hdfc which has a share limit but on cibil it shows 2 separate limit of 3.12 each is that how even share limit cards get reflected on cibil?As I can notice in the screenshot, their are 2 fields where you can improve:

PS: This are some Recommendations/Observations based on my personal experiences, I'm not a Credit Score Guru

- Make Credit Utilization between 3-7%

- Improve Credit Mix

Don't have accurate information regarding this, try to verify it first via HDFC customer care:I just noticed one more thing so my total limit on cibil stands at 21.08 however i have hdfc which has a share limit but on cibil it shows 2 separate limit of 3.12 each is that how even share limit cards get reflected on cibil?

If not what should i do.

I would love to have that limit of 5-6 lac and then share between the cards.

Currently there is no other way in which it can be shown as different cards needs to be reported separately and since you can use each card upto 3.12lakhs, it is reported like that. Some banks like SBI bifurcate the limits between different cards however having high potential to spend on each card if you have better returns in any particular transaction in one of them and not on others is better than having smaller individual limits. This is especially if the bank does not want to take too much exposure on any individual but still want to cater the need of other card.I just noticed one more thing so my total limit on cibil stands at 21.08 however i have hdfc which has a share limit but on cibil it shows 2 separate limit of 3.12 each is that how even share limit cards get reflected on cibil?

If not what should i do.

I would love to have that limit of 5-6 lac and then share between the cards.