Hello everyone,

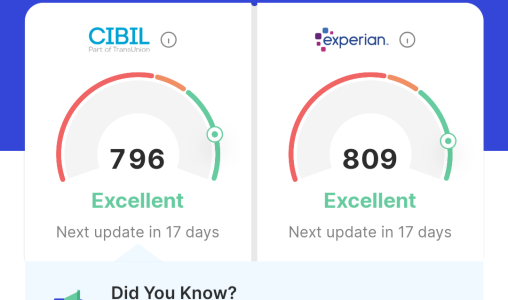

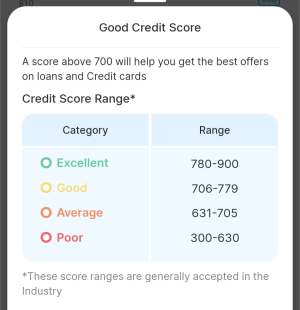

Recently my credit score dropped from 834 to 753 (Experian score). It happened after Paytm closed my Paytm Pay Later Lite account with Rs.2000 credit limit which was issued by Aditya Birla finance. I was actively using that pay later service for around 3-4 years and they suddenly closed that account with any notice. I had 100% on time payments on all of my pay later and credit cards.

Is there any possible way that I can raise disputed against it on Cibil so that I can gain my credit score back ? If Yes someone please explain how it can be done.

Thank You

Recently my credit score dropped from 834 to 753 (Experian score). It happened after Paytm closed my Paytm Pay Later Lite account with Rs.2000 credit limit which was issued by Aditya Birla finance. I was actively using that pay later service for around 3-4 years and they suddenly closed that account with any notice. I had 100% on time payments on all of my pay later and credit cards.

Is there any possible way that I can raise disputed against it on Cibil so that I can gain my credit score back ? If Yes someone please explain how it can be done.

Thank You