vishwas02

KF Rookie

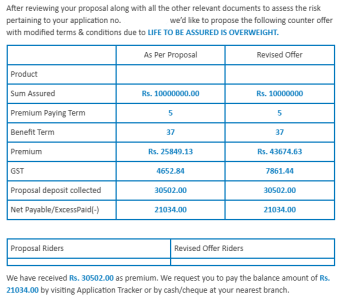

I am a 23-yrs old young male and recently started working this year. I applied for Bajaj E-touch term plan for 5 years and the premium was around 30-35k. After the medical test was done as I am overweight, my premium was increased by 21k (~70%). The insurance agent suggests that I should go ahead because my policy in approved in such extreme case if I cancel the policy now it will affect my future insurance applications as it will be recorded in my history just like default in CIBIL score in case of credit. I am confused what should I do here as the sole reason of buying a term plan at such early age is to get low premiums.

Edit - Also forgot to mention the test reports were completely normal. The agent said there a potential risk of diabetes in obese people, so insurance keep that also in account while increasing the premium.

Edit - Also forgot to mention the test reports were completely normal. The agent said there a potential risk of diabetes in obese people, so insurance keep that also in account while increasing the premium.

Attachments

Last edited: