Chitra Thakre

KF Ace

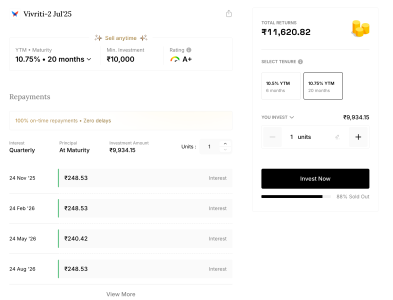

I am of the view that getting all the information at one place makes it easier for the customer. Also you can invest in schemes of any bank irrespective of the fact that you have account with that bank or notGot it. What I wanted to understand was - is there any specific benefit of using that platform? Why not directly invest via Bank?