card_hungry

KF Rookie

Hi Friends,

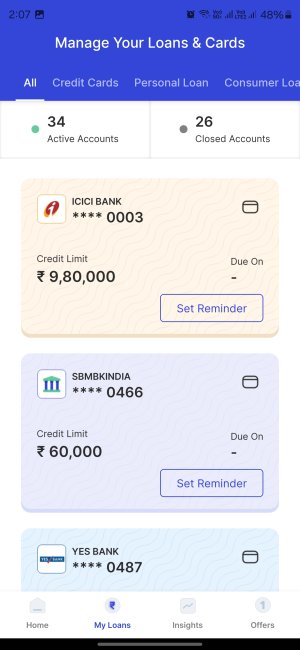

I am holding 25+ credits. I have almost all banks credit cards. I have 8+ Savings account in different banks.

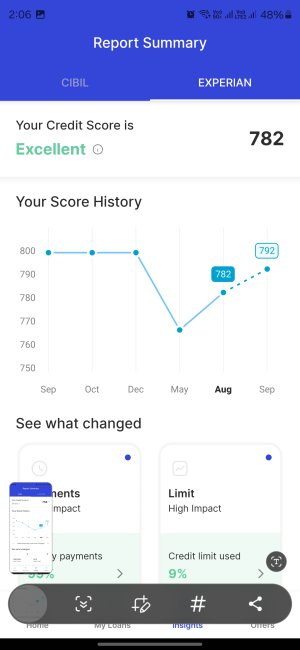

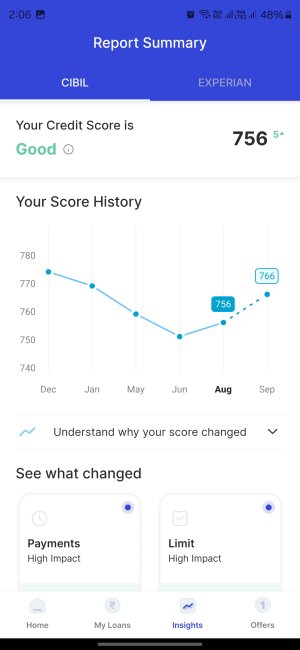

My Cibil is 756, Crif is 667 and experian is 782.

Do you think that I should close some of credits cards and savings also to increase the credit score?

I am holding 25+ credits. I have almost all banks credit cards. I have 8+ Savings account in different banks.

My Cibil is 756, Crif is 667 and experian is 782.

Do you think that I should close some of credits cards and savings also to increase the credit score?