Are you a frequent online shopper, especially on Amazon? If yes, then the Amazon Pay ICICI Bank Credit Card might just be the perfect addition to your wallet. Launched in collaboration with Amazon India on the Visa payment platform, this co-branded credit card has quickly become a favourite among Indian shoppers.

Fees and Benefits of ICICI Amazon Credit Card

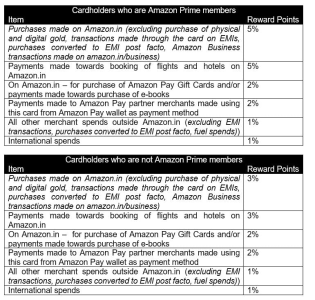

What is cool about the Amazon Pay ICICI Bank Credit Card? No joining or renewal fees; It's like getting all the benefits without spending and if you love shopping (who doesn't, right?), you're in for a treat. If you're an Amazon Prime member, you get a fantastic 5% cashback on your Amazon buys. And even if you're not a Prime member, you still score a sweet 3% cashback. Easy on the wallet and big on rewards – sounds like a win-win for all the shopping lovers out there!

Welcome Benefits:

New cardholders are greeted with a shower of welcome benefits, including cashback on prepaid recharges, Amazon shopping, postpaid recharge, electricity bill payments, DTH recharge, broadband recharge, and gas cylinder booking. The combined value of these benefits is a whopping Rs. 2,000.

Dining and Fuel Surcharge:

Dining out? Enjoy a minimum 15% discount at participating restaurants through ICICI Bank’s Culinary Treats program. Additionally, the card provides a 1% fuel surcharge waiver at all fuel stations across India (up to Rs. 4,000 transaction size).

Cashback Redemption:

Earning cashback is just the beginning. The beauty of this card lies in its seamless cashback redemption process. Accumulated reward points are automatically transferred to your Amazon Pay balance at the end of each billing cycle, ready to be used for your next Amazon shopping.

Eligibility and Application:

Originally an invite-only offering, the Amazon ICICI Credit Card is now open to all. To apply, you need a minimum monthly income of Rs. 25,000 for ICICI Bank customers and Rs. 35,000 for others. The application process involves KYC verification, which can be done via video mode or offline mode.

Comparison with Competitors:

While the Amazon ICICI Credit Card excels in Amazon-related benefits, other competitors like SBI Simply CLICK, HDFC Millennia, and Flipkart Axis Bank offer competitive reward rates on various online and offline spending. Consider your shopping preferences before choosing the right fit.

Final Verdict:

If you're a dedicated Amazon shopper, especially a Prime member, the Amazon Pay ICICI Bank Credit Card is a no brainer. With attractive cashback rates, welcome benefits, and easy redemption process, it's a go-to card for those who love to click and shop. Just keep in mind its focus on shopping benefits, as it might not be the best fit for frequent flyers seeking travel perks.

Fees and Benefits of ICICI Amazon Credit Card

What is cool about the Amazon Pay ICICI Bank Credit Card? No joining or renewal fees; It's like getting all the benefits without spending and if you love shopping (who doesn't, right?), you're in for a treat. If you're an Amazon Prime member, you get a fantastic 5% cashback on your Amazon buys. And even if you're not a Prime member, you still score a sweet 3% cashback. Easy on the wallet and big on rewards – sounds like a win-win for all the shopping lovers out there!

Welcome Benefits:

New cardholders are greeted with a shower of welcome benefits, including cashback on prepaid recharges, Amazon shopping, postpaid recharge, electricity bill payments, DTH recharge, broadband recharge, and gas cylinder booking. The combined value of these benefits is a whopping Rs. 2,000.

Dining and Fuel Surcharge:

Dining out? Enjoy a minimum 15% discount at participating restaurants through ICICI Bank’s Culinary Treats program. Additionally, the card provides a 1% fuel surcharge waiver at all fuel stations across India (up to Rs. 4,000 transaction size).

Cashback Redemption:

Earning cashback is just the beginning. The beauty of this card lies in its seamless cashback redemption process. Accumulated reward points are automatically transferred to your Amazon Pay balance at the end of each billing cycle, ready to be used for your next Amazon shopping.

Eligibility and Application:

Originally an invite-only offering, the Amazon ICICI Credit Card is now open to all. To apply, you need a minimum monthly income of Rs. 25,000 for ICICI Bank customers and Rs. 35,000 for others. The application process involves KYC verification, which can be done via video mode or offline mode.

Comparison with Competitors:

While the Amazon ICICI Credit Card excels in Amazon-related benefits, other competitors like SBI Simply CLICK, HDFC Millennia, and Flipkart Axis Bank offer competitive reward rates on various online and offline spending. Consider your shopping preferences before choosing the right fit.

Final Verdict:

If you're a dedicated Amazon shopper, especially a Prime member, the Amazon Pay ICICI Bank Credit Card is a no brainer. With attractive cashback rates, welcome benefits, and easy redemption process, it's a go-to card for those who love to click and shop. Just keep in mind its focus on shopping benefits, as it might not be the best fit for frequent flyers seeking travel perks.