Pavan_

KF Ace

Hey all,

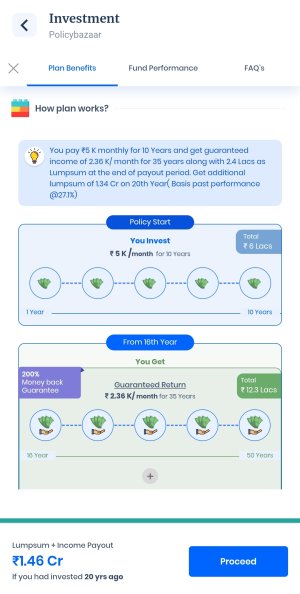

While planning for my taxation, i found about this so called " investment Plans" which allow us to save taxes under 80 C. Also the returns are really good.

So I was wondering how safe it is or has anyone been investing in this plan?

While planning for my taxation, i found about this so called " investment Plans" which allow us to save taxes under 80 C. Also the returns are really good.

So I was wondering how safe it is or has anyone been investing in this plan?

Attachments

Last edited: