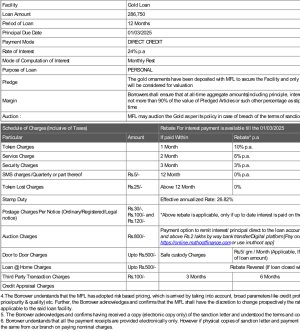

I’ve taken gold loan of 3lakhs in march 2023 with monthly interest of 1.2% which comes to 14.4% annual interest. In one year we paid around 14k principle only, rest of one payment was going to interest as I was financially unstable. In 2024, I had to renew the loan to continue the loan. So I was having 2.86L principle remaining. Muthoot staff called and told if we renew the loan of 3L to 2.86L, the total interest will reduce. And when I was renewing via online app, it was showing 14% only. I didn’t take any screenshot of that. I was not knowing they had sent a pledge letter of gold while renewing. Recently I came to know while I went to foreclose the loan that in this letter the annual rate of interest is mentioned as 24% which is way higher than they told. I was scammed and cheated. Anyway I went to their office and first closed the loan and got the gold.

I am having Overdraft of 14% annual rate (Bajaj Finserv Flexi Loan). So I took the amount from it and closed the gold loan. In Bajaj flexi loan, interest is charged only for the amount you withdrawn (eg: interest charged to 5L only out of 10L). The emi will be deducted only for interest for first few years and the tenure of loan is for 8 years. But you can do part payment which will go to principal amount. So I plan to part pay along with interest with which the interest also reduces in Bajaj flexi loan. One thing about Muthoot app is that they recently updated their app and I was not able to part pay into the principal amount. Whatever payment is showing is for interest alone. That is where I thought of this change.

Is it a right decision which I did?

I am having Overdraft of 14% annual rate (Bajaj Finserv Flexi Loan). So I took the amount from it and closed the gold loan. In Bajaj flexi loan, interest is charged only for the amount you withdrawn (eg: interest charged to 5L only out of 10L). The emi will be deducted only for interest for first few years and the tenure of loan is for 8 years. But you can do part payment which will go to principal amount. So I plan to part pay along with interest with which the interest also reduces in Bajaj flexi loan. One thing about Muthoot app is that they recently updated their app and I was not able to part pay into the principal amount. Whatever payment is showing is for interest alone. That is where I thought of this change.

Is it a right decision which I did?