Hi All,

I know we all hated ULIPS in the past for their exorbitant mortality and administration charges but with MF investing becoming easy as click of a button they soon lost their place as investment option.

Today I want to ask if investing in ULIPS for a long term give better returns than MF considering the returns from ULIP are tax free if below two conditions are met as per latest regulations.

I know the charges of ULIP are bit higher than MF expense ratio, however I wanted to understand the below scenario but unable to come to an exact conclusion if there are any other factors that could impact the returns.

Lets say if person A is investing in ULIP (equity linked) of 2 Lakh year for 20 years and similarly person B is investing 2 Lakh a year in MF of the same underlying equity schemes that the ULIP is investing.

Now after 20 Years the returns of ULIP could be less that of MF as the charges levied every year on ULIP eat up from the returns, but MF would also attract 10% LTCG on any profit exceeding 1 Lakh at the time of maturity.

If both Person A and Person B redeeming their investments after 20 Years would ULIP returns be more than MF (post LTCG deduction in MF)?

Note: ULIP will pay Sum Assured (20 Lakh in the above case along with returns) in the term period if something happens to the customer but MF may only give back the investment along with returns accumulated so far to Nominee.

I don't want to compare Term insurance to ULIP as an insurance product but solely want to check if ULIP has advantage over MF as an "investment + insurance + Tax free" returns in an equity linked scheme if that even makes sense.

I know we all hated ULIPS in the past for their exorbitant mortality and administration charges but with MF investing becoming easy as click of a button they soon lost their place as investment option.

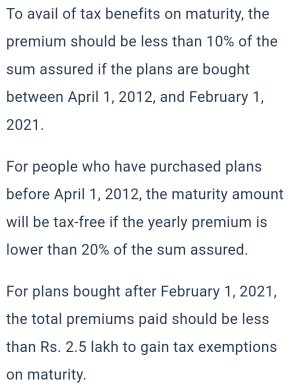

Today I want to ask if investing in ULIPS for a long term give better returns than MF considering the returns from ULIP are tax free if below two conditions are met as per latest regulations.

First condition is an individual shall not be investing more than 2.5 Lakh in a year

Second the sum assured shall not exceed 10 times the premium paid.

Given above two conditions are met the returns from ULIPS are tax free under section 10(10D) - Correct me this is wrong...I know the charges of ULIP are bit higher than MF expense ratio, however I wanted to understand the below scenario but unable to come to an exact conclusion if there are any other factors that could impact the returns.

Lets say if person A is investing in ULIP (equity linked) of 2 Lakh year for 20 years and similarly person B is investing 2 Lakh a year in MF of the same underlying equity schemes that the ULIP is investing.

Now after 20 Years the returns of ULIP could be less that of MF as the charges levied every year on ULIP eat up from the returns, but MF would also attract 10% LTCG on any profit exceeding 1 Lakh at the time of maturity.

If both Person A and Person B redeeming their investments after 20 Years would ULIP returns be more than MF (post LTCG deduction in MF)?

Note: ULIP will pay Sum Assured (20 Lakh in the above case along with returns) in the term period if something happens to the customer but MF may only give back the investment along with returns accumulated so far to Nominee.

I don't want to compare Term insurance to ULIP as an insurance product but solely want to check if ULIP has advantage over MF as an "investment + insurance + Tax free" returns in an equity linked scheme if that even makes sense.