Master Chief

KF Ace

Please read my full post and try to answers all my questions so that i can make best decision and not regret later

I have been seeing Pre-qualified credit card banner when logging onto SBI net banking and YONO app for quite sometime, also got call from Home branch informing me that i am eligible for pre-approved credit card and just need to visit branch with PAN and Aadhaar, when i asked is it necessary to visit branch, can't i apply from YONO app as its showing me a Pre-qualified credit card banner she said you may but application might get stuck better to visit branch (she might be saying that so that apply through her only and she gets commission). Now i have few questions

1) Which card to apply Cashback or SimplyClick/SimplySave or any other ? Cashback card is good but i also want to have card for upcoming sale offers

Which card it will be beneficial to go for first so that afterwards its easier to get 2nd card as Pre-approved and maybe FYF (if not LTF)

NOTE: I already have Airtel Axis Card which covers most of my bills

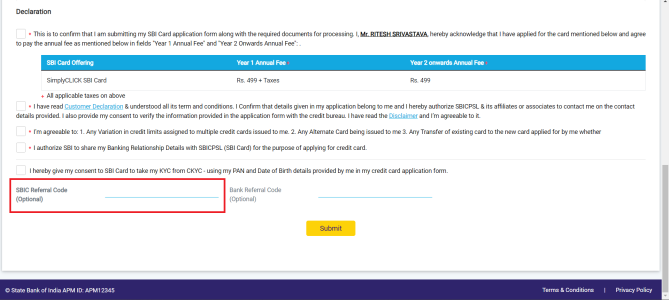

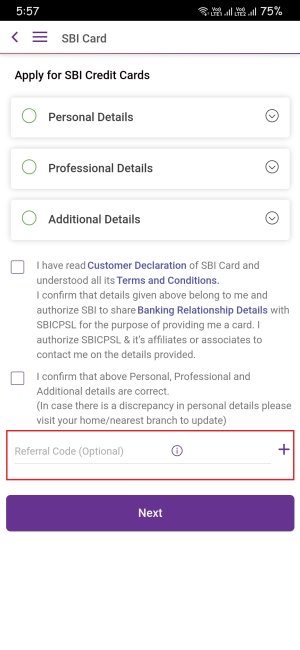

2) I will be applying either through SBI net banking or YONO app so can i apply referral code here (1st & 2nd image) or applying only through referral link is considered as valid referral. If referral code applied will I get ₹500 voucher for Cashback card too or not and in case I apply for SimplyClick will i get ₹500+₹500 voucher (as simplyclick already gives one ₹500 voucher as Welcome gift )

I have been seeing Pre-qualified credit card banner when logging onto SBI net banking and YONO app for quite sometime, also got call from Home branch informing me that i am eligible for pre-approved credit card and just need to visit branch with PAN and Aadhaar, when i asked is it necessary to visit branch, can't i apply from YONO app as its showing me a Pre-qualified credit card banner she said you may but application might get stuck better to visit branch (she might be saying that so that apply through her only and she gets commission). Now i have few questions

1) Which card to apply Cashback or SimplyClick/SimplySave or any other ? Cashback card is good but i also want to have card for upcoming sale offers

Which card it will be beneficial to go for first so that afterwards its easier to get 2nd card as Pre-approved and maybe FYF (if not LTF)

NOTE: I already have Airtel Axis Card which covers most of my bills

2) I will be applying either through SBI net banking or YONO app so can i apply referral code here (1st & 2nd image) or applying only through referral link is considered as valid referral. If referral code applied will I get ₹500 voucher for Cashback card too or not and in case I apply for SimplyClick will i get ₹500+₹500 voucher (as simplyclick already gives one ₹500 voucher as Welcome gift )