Akshat Rathore

KF Rookie

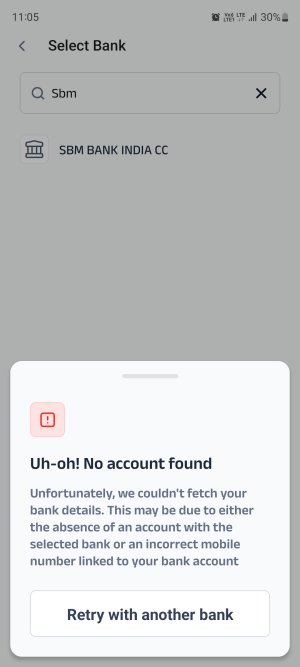

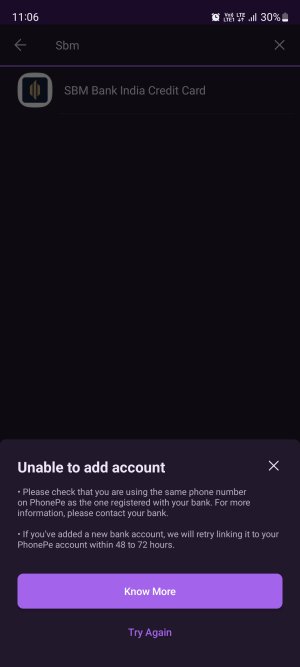

Hey I m looking for my first cc as I have no credit score rn, no credit history. So I need a rupay cc which I can connect on UPI for my ease. While spending by UPI my credit score will grow, not rapidly but still it's good to build it from scratch on slow pace. Is Paisabazaar stepup cc good option as a first or entry level cc, not for rewards, cashback, n all but for credit score to move from -1 and grow. If my cibil score will be high, so automatically I will be eligible for many other good cc but my main concern is will I be able to connect it on apps like gpay or phonepe, coz on gpay the sbm bank is not available in the list of rupay cc & on phonepe sbm bank india cc is mentioned which is quite confusing. Is it good move to get a stepup cc

Can anyone help about it?

Any info

Thanksin advance

Can anyone help about it?

Any info

Thanksin advance