Before knowing nothing about credit reporting Date, I use to keep my credit utilization ratio below 30% as my billing date approaches but after bill generation completed I exhaust all my credit limit, after I check my credit report I wonder how my utilization ratio is very high .. after few days I saw Manu bisht video , I got know about credit reporting date , I tried if it will work or not ,1st month my CIBIL Score was 740 as of Date : 07/08/2024. 2nd month my CIBIL Score was 772 as of Date:11/08/2024

3rd and current month my CIBIL Score is 732 as of Date : 07/09/2024

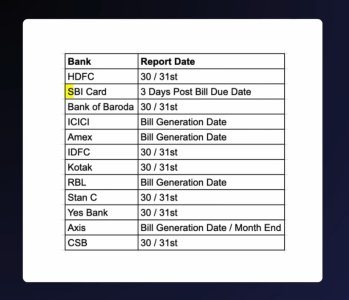

It is true even if your credit utilization is high on bill statement pay total outstanding by reporting date ..

3rd and current month my CIBIL Score is 732 as of Date : 07/09/2024

It is true even if your credit utilization is high on bill statement pay total outstanding by reporting date ..

Last edited: