anuragmukherjee28

Moderator

Last edited:

truee, I agreeI prefer infinite because of much better reward.

But and this is Big But, it is AXIS Bank, so Reliability is a Big concern. You can never know when they decide to devalue you saved reward points

no we dont get 10% off for both the cards and thats the catchFor samsung purchaes, don"t we get 10% cashback for both cards?

no we dont get 10% off for both the cards and thats the catch

but on the samsungs page the data is different , check I have attached the screenshot , this is very confusingBut its written on website

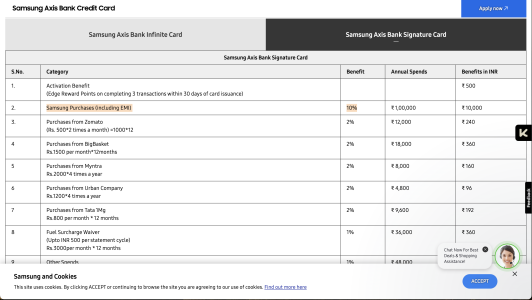

Signature Variant:

10% Cashback* for spends on Samsung Products & Services (Upto ₹ 2500 per month and Upto ₹ 10000 annually)

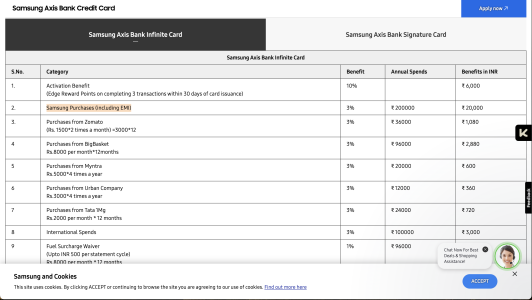

Infinite Variant:

10% Cashback* for spends on Samsung Products & Services (Upto ₹ 5000 per month and Upto ₹ 20000 annually

UpdatedIm screenshot, its also mentioned for annual spends.

Singnature -- annual spend 1,00,000 , savings - 10,000

Infinite -- annual spends 2,00,000 savings - 20,000

So its 10% cashback

Yes above mentioned table are true, but when you call customer care and ask for 10% confirmation query then they will say 10% is caped at Rs........../- amountbut on the samsungs page the data is different , check I have attached the screenshot , this is very confusing

View attachment 233

View attachment 234