You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

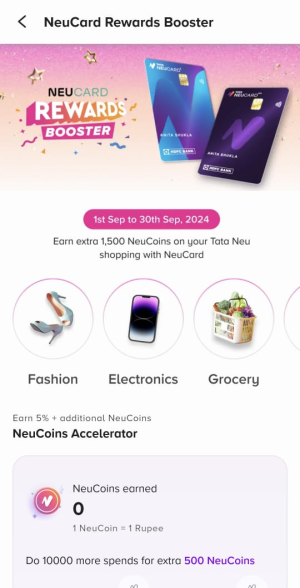

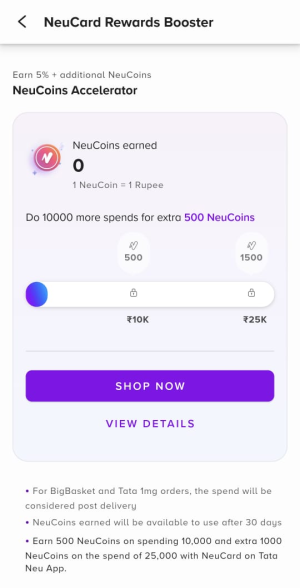

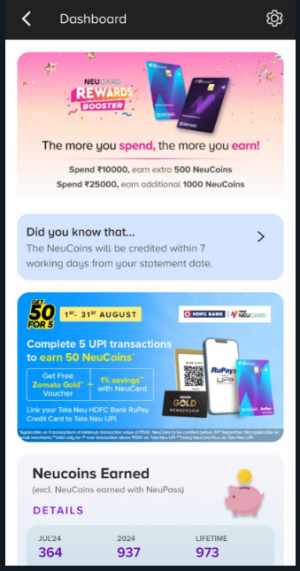

Spend Based Offer: 500/1500 Extra Neu coins on 10K and 25K spend. TATA HDFC NeuCard Rewards Booster

- Thread starter Skylar

- Start date

Vara Prasad

KF Ace

The catch here is the reward is only applicable when you shop on Tata Neu and it doesn't even include bills paid via Tata Neu.

Hanush Kumar

KF Expert

What do you use Tata Neu cards for? Do you mind paying the annual fees if you cannot spend 1L in a year?View attachment 1647View attachment 1648

Spetember 1st to 30th Get Extra rewards on Tata neu app using HDFC TATA Neu Credit card.

Spend 10k with Neu card and get 500 extra Neu coins

Spend 25k with Neu card and get 1500 extra Neu coins

Total of 2000 coins on spend of 35k

I don't use/spend much on Tata branded products.

Skylar

KF Master

Skylar

KF Master

I am currently using the Tata Neu website for UPI payments, but I am not a fan of the platform as the products are overpriced, and the returns are provided in the form of NeuCoins.What do you use Tata Neu cards for? Do you mind paying the annual fees if you cannot spend 1L in a year?

I don't use/spend much on Tata branded products.

Additionally, promotional offers for bill payments are often not credited to the account.

Although I am considering closing the card, I have already reached the fee waiver threshold, so I plan to keep it for another year.

I shared this offer for Tata enthusiasts who exclusively shop on Tata sites regardless of the price.

Hanush Kumar

KF Expert

Thanks. I was hearing a lot about Tata Neu cards very often nowadays. So I was curious as in what kind of benefits does it have to offer.I am currently using the Tata Neu website for UPI payments, but I am not a fan of the platform as the products are overpriced, and the returns are provided in the form of NeuCoins.

Additionally, promotional offers for bill payments are often not credited to the account.

Although I am considering closing the card, I have already reached the fee waiver threshold, so I plan to keep it for another year.

I shared this offer for Tata enthusiasts who exclusively shop on Tata sites regardless of the price.

I'm currently using HDFC IOCL and SBI simplysave. I'm contemplating switching to RBL IOCL and some other HDFC card after a year.

Do you think RBL is reliable and has good customer support?

Vara Prasad

KF Ace

I use Tata Neu Infinity mainly because it gives 5% as Neu coins on Utility and Insurance payments.What do you use Tata Neu cards for? Do you mind paying the annual fees if you cannot spend 1L in a year?

I don't use/spend much on Tata branded products.

I have pay an LIC premium of at least 60,000/- per year, 5% of which equals to 3k, which is double the yearly fee of 1500/-.

Also it provides 1.5% as neu coins on EMI payments as well.

Skylar

KF Master

RBL and reliable nopeDo you think RBL is reliable and has good customer support?

Hanush Kumar

KF Expert

Does insurance payments attract that 2% + GST charges while using Tata Neu Infinity card?I use Tata Neu Infinity mainly because it gives 5% as Neu coins on Utility and Insurance payments.

I have pay an LIC premium of at least 60,000/- per year, 5% of which equals to 3k, which is double the yearly fee of 1500/-.

Also it provides 1.5% as neu coins on EMI payments as well.

Also have they explicitly mentioned insurance payments earn rewards in their clause?

Hanush Kumar

KF Expert

My EMI payments are getting debited from my savings account. I got loan from SBI and my savings account is in HDFC.

Is it possible to change the mandate from HDFC savings account to Tata Neu Infinity Credit Card?

Is it possible to change the mandate from HDFC savings account to Tata Neu Infinity Credit Card?

archit3000

KF Ace

There is no fee for Insurance payments. I am earning 5% NC from the last 3 months regularlyDoes insurance payments attract that 2% + GST charges while using Tata Neu Infinity card?

Also have they explicitly mentioned insurance payments earn rewards in their clause?

archit3000

KF Ace

sorry, I am not getting this offer

Hanush Kumar

KF Expert

Does an auto loan considered EMI payments?Also it provides 1.5% as neu coins on EMI payments as well.

got 1.5% only. how you got 5%??I use Tata Neu Infinity mainly because it gives 5% as Neu coins on Utility and Insurance payments.

I have pay an LIC premium of at least 60,000/- per year, 5% of which equals to 3k, which is double the yearly fee of 1500/-.

Also it provides 1.5% as neu coins on EMI payments as well.

paying with neu card instead of upi?There is no fee for Insurance payments. I am earning 5% NC from the last 3 months regularly

where does it say this?The catch here is the reward is only applicable when you shop on Tata Neu and it doesn't even include bills paid via Tata Neu.

archit3000

KF Ace

yes and on Neu app only, u wont get 5% back on any other app using neu cardpaying with neu card instead of upi?

Vara Prasad

KF Ace

You might have paid via Tata Neu UPI. Try making the payment by entering your card details and complete the transaction by entering the OTP.got 1.5% only. how you got 5%??

You will get 5% as cashback in the statement.

Vara Prasad

KF Ace

I am not sure but in my case I have two EMIs one in Amazon and other in Flipkart. Getting 1.5% as cashback on the principal amount each month.Does an auto loan considered EMI payments?

Similar threads

- Replies

- 1

- Views

- 465

- Replies

- 3

- Views

- 757

- Replies

- 13

- Views

- 915

- Replies

- 8

- Views

- 1K