Zombie96

KF Ace

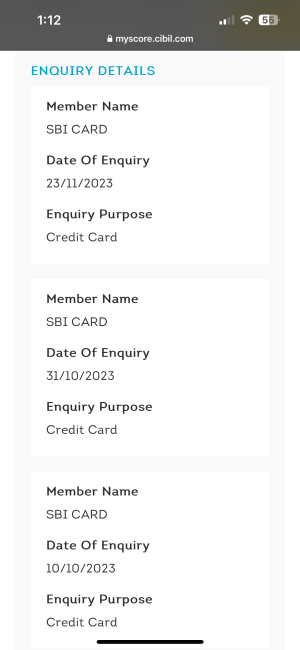

Around 1.5 years ago, my bank (SBI) made three unauthorized hard pulls on my CIBIL report when I applied for a credit card, without my consent.

- This significantly damaged my credit score, making me ineligible for regular credit cards at the time.

- Despite providing proof of these hard pulls, the bank did not restore my score or take accountability.

- Instead, they pressured me to open a fixed deposit of ₹30,000 and gave me a credit card with a ₹22,000 limit against it.

- I am a salaried individual, yet they treated me like a credit risk instead of correcting their mistake.

- I’m now demanding a written explanation from the bank regarding their actions and refusal to reverse the damage.

- My CIBIL score is now 798, thanks to responsible credit usage—not because of any help from the bank.

- Despite this, the bank has repeatedly called me over the past year, trying to sell me personal loans, likely after seeing my updated score.

- I suspect this hard-pull + FD trick may be a systematic tactic used on other customers as well.

- I demand an inquiry against the branch manager and the specific employee involved, and I also want help closing my FD-linked credit card, which cannot be done via the app.