Tax with Ria

KF Expert

What is Advance Tax?

Advance tax is the income tax that is paid in advance instead of lump sum payment at year end. It is the tax that you pay as you earn. These payments have to be made in instalments as per due dates provided by the income tax department.

Advance tax liability arises if your net tax liability for the FY is more than ₹10000. Generally Advance Tax for any F.Y has to be paid in following instalments for individuals or corporate taxpayers-

| 15th June | 15% of Advance tax |

| 15th September | 45% of Advance tax(-) advance tax already paid |

| 15th December | 75% of Advance tax(-) advance tax already paid |

| 15th March | 100% of Advance tax(-) advance tax already paid |

The advance tax applies to all taxpayers, salaried, freelancers, and businesses.

1. To whom Advance Tax does not applies?

People aged 60 years or more, and do not run a business, are exempt from paying advance tax.

Salaried Individual whose TDS is deducted by employer and 90% of estimated tax liability is already deducted by way of TDS, are exempt from paying advance tax.

2. Who needs to pay on/before 15th March?

Taxpayers who have opted for the presumptive taxation scheme under section 44AD have to pay the whole amount of their advance tax in one instalment on or before 15 March. They also have the option to pay all of their tax dues by 31 March.

Independent professionals such as doctors, lawyers, architects, etc. come under the presumptive scheme under section 44ADA. They have to pay the whole of their advance tax liability in one instalment on or before 15 March. They can also pay the entire amount by 31 March.

3. If you do not pay/delay in Advance Tax?

Non payment of Advance Tax-

As per Section 234B, you must pay at least 90% of the total taxes as advance tax by 31st March. Failure to make advance tax payments will result in an interest @ 1% on the unpaid amount.

Delay in payment of advance tax will attract interest under 234C

| Particulars | Rate of Interest | Period of Interest | Amount on which interest is calculated |

| If Advance Tax paid by 15th June is less than 15% | 1% per month | 3 months | 15% of Amount* (-) tax paid before June 15 |

| If Advance Tax paid by 15th September is less than 45% | 1% per month | 3 months | 45% of Amount* (-) tax paid before September 15 |

| If Advance Tax paid by 15th December is less than 75% | 1% per month | 3 months | 75% of Amount* (-) tax paid before December 15 |

| If Advance Tax paid by 15th March is less than 100% | 1% per month | 1 month | 100% of Amount* (-) tax paid before March 15 |

So remember to pay your advance tax on time to avoid any interest payment during due date of return filing in July/ September.

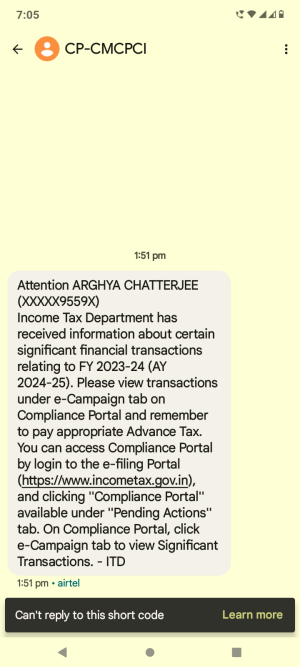

You can pay your advance tax from "e-pay" tab in efiling portal and generate a challan from there.

Hope it helped you

Last edited: