Hanush Kumar

KF Expert

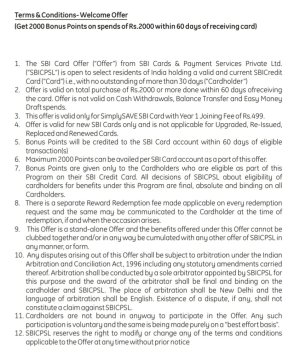

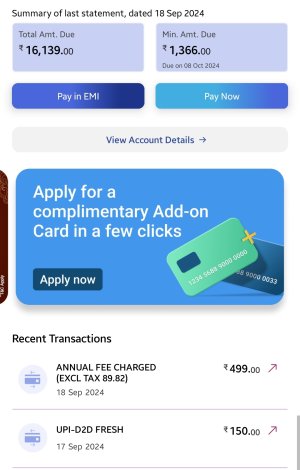

1. I have an outstanding of around 16k for this month (first month) and the joining fee was deducted only on the statement generation date. I want clarity on the first point of terms and conditions (pls refer to the attachments) as in I have already spent Rs. 2000. Should I be spending another Rs. 2000 this month (that too after clearing the outstanding) for me to be eligible for the 2000 rewards?

2. Why was the joining fee deducted after 30 days and not at the beginning?

3. In order to get the 2000 reward points, the terms and conditions say I should spend Rs. 2000 within 60 days of receiving the card. Also, it mentions something about 30 days outstanding, which I couldn't comprehend. Please help me here.

4. Also, a couple of weeks ago, I received a call from one of the sbi card agents. Apparently, they were offering SBI SimplyClick card (entry level) as LTF. Since I already got two credit cards last month, I didn't want to take a hit on my CIBIL (currently 750) and checked whether they could convert my existing SimplySave (entry level) into LTF. They said no. Should I have gone with their offer or should I get more advanced card like sbi cashback?

2. Why was the joining fee deducted after 30 days and not at the beginning?

3. In order to get the 2000 reward points, the terms and conditions say I should spend Rs. 2000 within 60 days of receiving the card. Also, it mentions something about 30 days outstanding, which I couldn't comprehend. Please help me here.

4. Also, a couple of weeks ago, I received a call from one of the sbi card agents. Apparently, they were offering SBI SimplyClick card (entry level) as LTF. Since I already got two credit cards last month, I didn't want to take a hit on my CIBIL (currently 750) and checked whether they could convert my existing SimplySave (entry level) into LTF. They said no. Should I have gone with their offer or should I get more advanced card like sbi cashback?

Attachments

Last edited: