kaushik_dutta

KF Ace

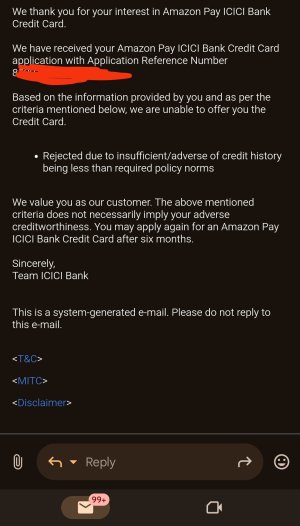

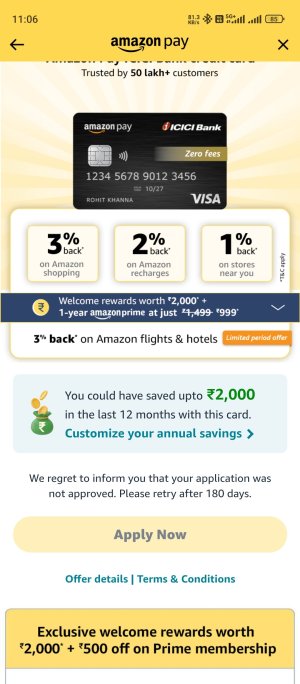

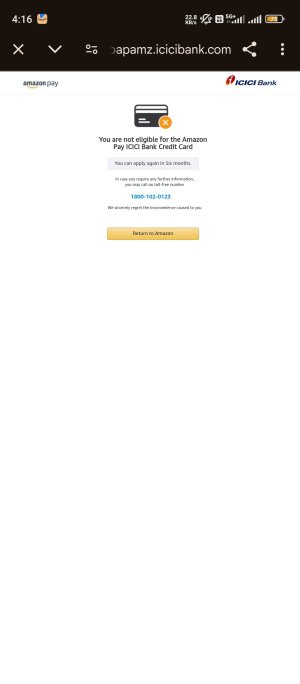

I have applied through Amazon pay yesterday apply option was visible so I have instantly applied but got declined. Mail received that due to adverse credit/not meeting policy criteria. I'm using hdfc Swiggy card from last 4 months and IDFC WOW card from last 1.5yrs. I have 1L Personal loan for 24 months. Out of which 3 paid. So now tell me why I'm ineligible for the same. 7 days back I have for axis myzone rupay card same also rejected. That in Google message banner received. So please tell me what to do for the approval. My cibil is 752, Experian is: 750 and equifax is 785.

Please suggest what to do to get the card for the same.

Please suggest what to do to get the card for the same.