NitishKumar

KF Ace

Hi Team,

I am first time investing in MF,

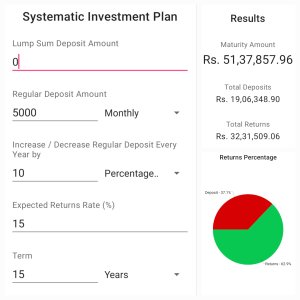

Target is, to invest 12-15 years in Mutual Funds, with 10K/Month and increase it by 10% every year.

Expecting 15% or more profit, this corpus can be utilized for kids education or for retirement.

Now, which are suitable for this requirement, either large cap or mid cap or small cap or flexi etc. I would like to have 3-4 categories in my portfolio.

Now after selecting cap, which risk factor i need to consider,

high or moderately high or very high or moderate or moderately low or low.

Kindly suggest on this and also suggest whether to change investment years , investment amount etc.

I am first time investing in MF,

Target is, to invest 12-15 years in Mutual Funds, with 10K/Month and increase it by 10% every year.

Expecting 15% or more profit, this corpus can be utilized for kids education or for retirement.

Now, which are suitable for this requirement, either large cap or mid cap or small cap or flexi etc. I would like to have 3-4 categories in my portfolio.

Now after selecting cap, which risk factor i need to consider,

high or moderately high or very high or moderate or moderately low or low.

Kindly suggest on this and also suggest whether to change investment years , investment amount etc.