anuragmukherjee28

Moderator

All banks provide the basic features that customers need on a day-to-day basis. So, to choose where to open a savings account, you should consider the following factors:

*all the datas are for savings less than 10 crores and for normal people

hope this helps,if you have any doubt, just reply to this thread and I will try to reply to you

- Interest rate: This is the main factor to consider when choosing a savings account. Compare interest rates offered by different banks to find the one that offers the highest rate. ( Have done this for you in this post )

- Branch proximity: It is convenient to have a bank branch close to your home or workplace.

- Staff behavior: they should be cooperative and you should not need to waste a lot of time for your banking needs.

*all the datas are for savings less than 10 crores and for normal people

| Bank | Savings Account Interest Rate |

| State Bank of India (SBI) | 2.70% - 3.00% |

| HDFC Bank | 3.00% - 3.50% |

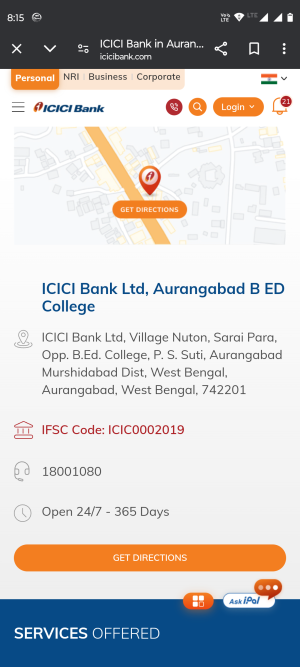

| ICICI Bank | 3.00% - 3.50% |

| Axis Bank | 3.00% - 3.50% |

| Kotak Mahindra Bank | 3.50% - 4.00% |

| IDFC First Bank | 3.00% - 7.00% |

| Bandhan Bank | 3.00%-6.50% |

| AU Small Finance Bank | 3.50% - 7.00% |

| Paytm Payments Bank | 2%-2.50% |

| Bank of Baroda (BoB) | 2.75% - 3.35% |

| Punjab National Bank (PNB) | 2.70% |

| Union Bank of India (UBI) | 2.75% - 2.90% |

| Canara Bank | 2.75% - 3.25% |

| Bank of Maharashtra (BoM) | 2.75% |

| Indian Overseas Bank (IOB) | 2.70% - 3.20% |

| UCO Bank | 2.70% - 3.20% |

| Central Bank of India (CBI) | 2.70% - 3.20% |

| Bank of India (BoI) | 2.70% - 3.20% |

| Yes Bank | 4.00% |

| South Indian Bank | 3.00% - 3.50% |

| Federal Bank | 3.00% - 3.50% |

| DBS Bank India | 3.00% |

hope this helps,if you have any doubt, just reply to this thread and I will try to reply to you

Last edited: