Pahulpreet Kaur

KF Mentor

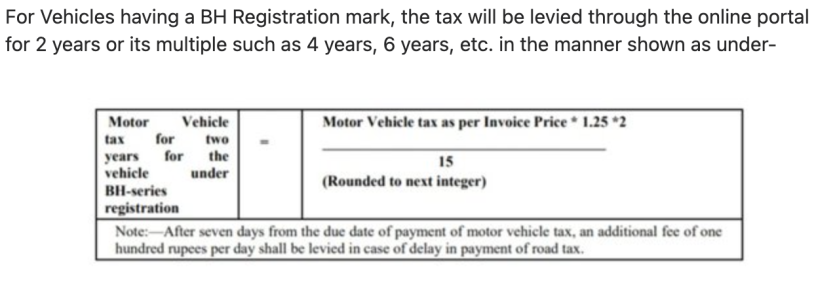

Does any body has an Idea how much tax to be paid every two years on a bike (Royal Enfield) on BH number?

| Vehicle Type | Registration Charge (%) | Registration Fee (2 years) |

|---|---|---|

| Petrol/CNG | 8 | ₹10666.67 |

| Electric | 6 | ₹8000.00 |

| Diesel | 10 | ₹13333.33 |