17ysaurabh

KF Mentor

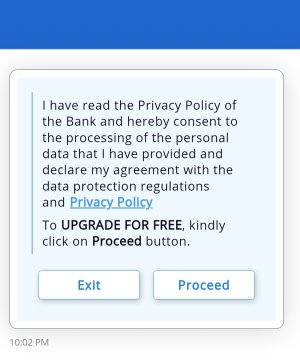

Hey guys, I recently got an email from HDFC Bank that I have got a free upgrade to the Classic Banking Programme.

Does anyone have any idea about this? Is it good? Should I upgrade?

Does anyone have any idea about this? Is it good? Should I upgrade?