Jaibeer Singh

KF Ace

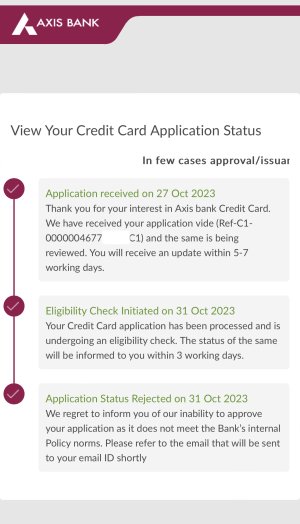

Disappointed all alot,Reason my axis bank credit card got rejected for the 3rd time even though this time I applied it from bank executive,every time they give be offer for an axis bank credit card and after that they reject my application,I Have Axis bank saving account for more than 3 years now and I have been using Indian Oil Axis bank Credit Card( FD based) from 1.5 years without any delay in payment. Please guys help me out on this on how can I increase my chances of getting an Unsecured Axis Credit Card. THANKS IN ADVANCE GUYS