Personal Finance by Nish…

KF Mentor

Hi All,

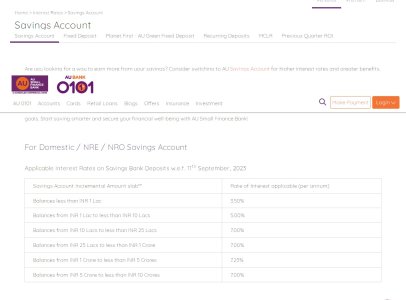

Let’s start the discussion on most common topic related to banks & financial institutions with high rate of interest.

Best NBFCs, banks & financial institutions who providing best interest rate on their saving accounts, best features of the account as on october 2023.

Also share your banking experience with product facility, pros and cons.

Let’s start the discussion on most common topic related to banks & financial institutions with high rate of interest.

Best NBFCs, banks & financial institutions who providing best interest rate on their saving accounts, best features of the account as on october 2023.

Also share your banking experience with product facility, pros and cons.