smakash111

KF Ace

This was the actual asking of mine posted 10 days ago - no answer received.

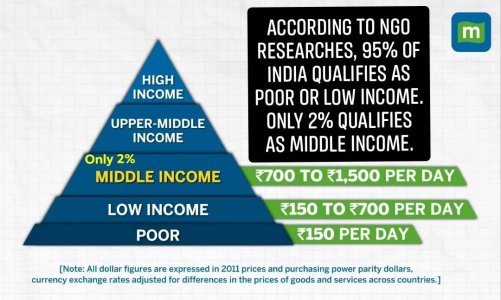

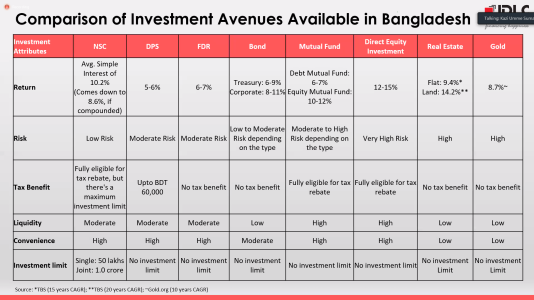

Q1: "What should be my monthly earning and "Want : Need : Save" ratio to maintain a true middle class (middle income) life style?

Feel free to ask more questions and advice accordingly.

Q2. (New) Should I consider "double benefit scheme" over FD and Mutual Fund - so much so that, I shall break my FD to invest in these double beenfit schemes? Do you find any terms of this "double benefit scheme" concerning?

Bangladeshi Flat/Home Owner, 1st generation Lawyer (Highly Inconsistent Income), Unmarried, 32 years old, 5 dependents, No intention of leaving the Country ever.

Future Target - Good Car, Marriage by 35. No intention of Taking Dowry. Good Car is easily over 10 Lakh Taka and Yearly Tax for a 1500cc Car is 35,000 and salary of a Driver is 15,000 per month.

> Home Loan left 12.8 Lakh at 10%

> Inflation 15% (NGO Data), 9.9% (Goverment Data)

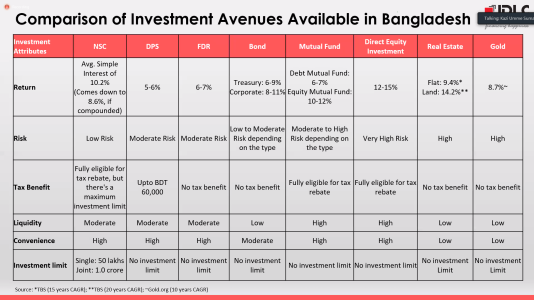

> Fixed Deposit 23 lakh at 11% annual return after tax

> Stock Market is unreliable. Recently Mututal Funds reported loss.

> Insurance policies are not attractive here in Bangladesh compare to India

> 2026 gonna be a very bad year for Bangladesh financially according to the experts and Sri Lanka like situation may arise.

> Local Currancy "Taka" is losing its value very quickly. There is a genuine scarcity of US Dollar in the Banks. Legally, No Bank can't ask more than 117 taka for selling 1 USD but in reality, but deparate people are paying 125 taka - 127 taka to buy 1 USD from the kerb market.

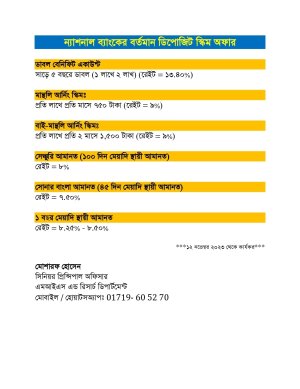

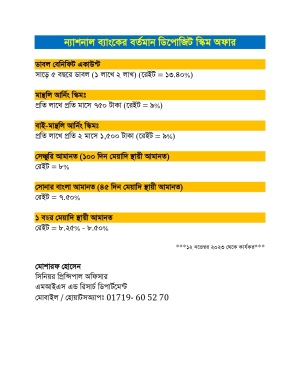

Double Benefit Scheme:

2 reputed Banks and other 7 lesser known Banks in Bangladesh are now offering "Double Benefit Schemes", which doubles my money in 5 years. To double my money in 5 years, the Rule of 72 suggests that expected return rate (p.a) should not be less than 14.4% (72 / 5 = 14.4).

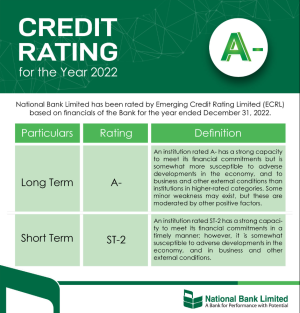

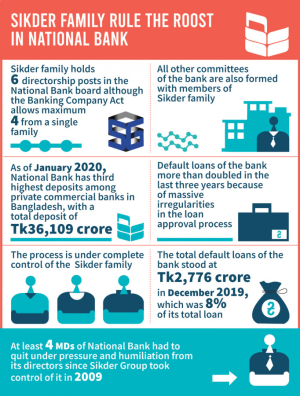

I am seriously considering the Double Benefit Scheme of the National Bank of Bangladesh so much so that I want to break my 23 Lakh FD at the Post Office (11% Annual return) and invest 20 Lakh to the National Bank of Bangladesh's Double Benefit Scheme.

Q1: "What should be my monthly earning and "Want : Need : Save" ratio to maintain a true middle class (middle income) life style?

Feel free to ask more questions and advice accordingly.

Q2. (New) Should I consider "double benefit scheme" over FD and Mutual Fund - so much so that, I shall break my FD to invest in these double beenfit schemes? Do you find any terms of this "double benefit scheme" concerning?

Bangladeshi Flat/Home Owner, 1st generation Lawyer (Highly Inconsistent Income), Unmarried, 32 years old, 5 dependents, No intention of leaving the Country ever.

Future Target - Good Car, Marriage by 35. No intention of Taking Dowry. Good Car is easily over 10 Lakh Taka and Yearly Tax for a 1500cc Car is 35,000 and salary of a Driver is 15,000 per month.

> Home Loan left 12.8 Lakh at 10%

> Inflation 15% (NGO Data), 9.9% (Goverment Data)

> Fixed Deposit 23 lakh at 11% annual return after tax

> Stock Market is unreliable. Recently Mututal Funds reported loss.

> Insurance policies are not attractive here in Bangladesh compare to India

> 2026 gonna be a very bad year for Bangladesh financially according to the experts and Sri Lanka like situation may arise.

> Local Currancy "Taka" is losing its value very quickly. There is a genuine scarcity of US Dollar in the Banks. Legally, No Bank can't ask more than 117 taka for selling 1 USD but in reality, but deparate people are paying 125 taka - 127 taka to buy 1 USD from the kerb market.

Double Benefit Scheme:

2 reputed Banks and other 7 lesser known Banks in Bangladesh are now offering "Double Benefit Schemes", which doubles my money in 5 years. To double my money in 5 years, the Rule of 72 suggests that expected return rate (p.a) should not be less than 14.4% (72 / 5 = 14.4).

I am seriously considering the Double Benefit Scheme of the National Bank of Bangladesh so much so that I want to break my 23 Lakh FD at the Post Office (11% Annual return) and invest 20 Lakh to the National Bank of Bangladesh's Double Benefit Scheme.

Attachments

Last edited: