Hanush Kumar

KF Ace

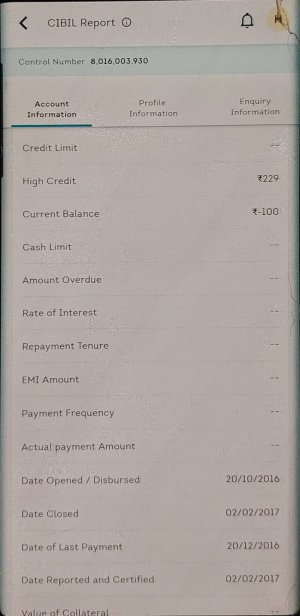

I have closed one of my earlier credit cards in 2017 (please refer to attachments). I'm not sure whether it is closed properly. Can anyone please verify whether my credit card account is properly closed or not?

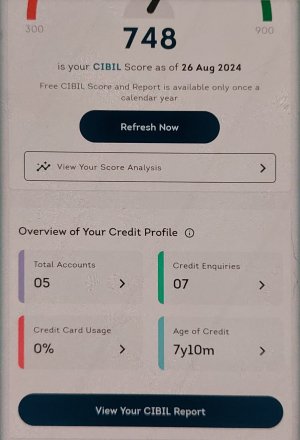

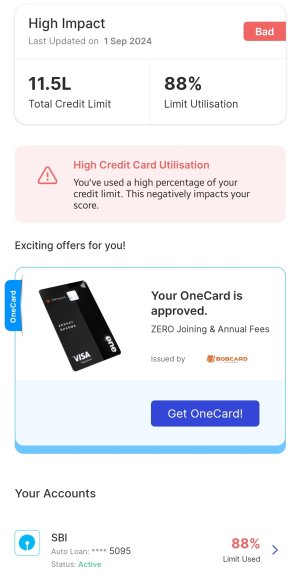

The reason behind this check is, my credit history spans for 7+ years. I have paid all my dues on time. Yet the CIBIL score is 748.

The reason behind this check is, my credit history spans for 7+ years. I have paid all my dues on time. Yet the CIBIL score is 748.