I am here to highlight a scam done by One Card App by putting false terms and conditions for buying Gift Card from the App.

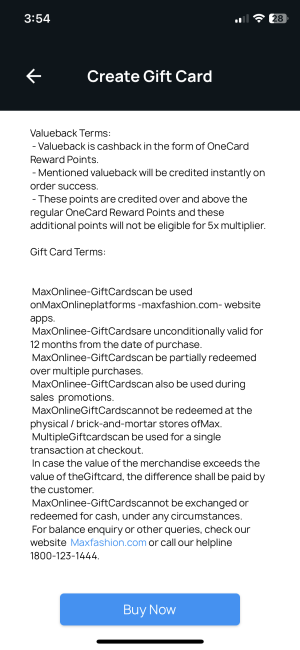

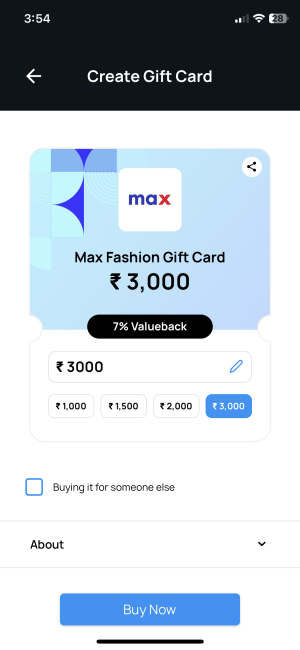

I had recently purchased a Max fashion Gift Card from One Card App and read the terms and conditions mentioning its redeemable online on max fashion website.

On Redemption, it stated invalid Gift Card for which I raised a complaint to One Card.

One Card Customer Support Executive asked me contact Qwik silver Gift Card issuer directly and closed the ticket without any resolution.

After multiple follow ups, and raising the complaint to One Card Nodal Officer, they called and told me the Gift Card is redeemable only at offline stores.

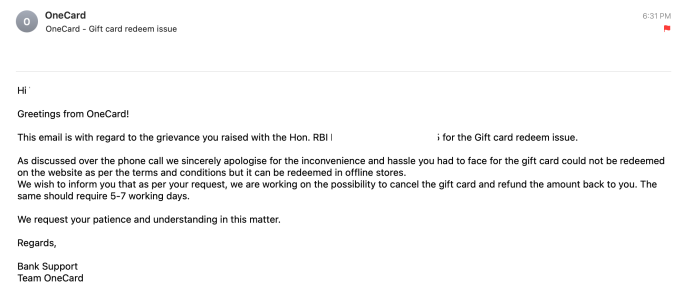

I sent them the terms and conditions screenshot and App Video Recording, and they intentionally delayed the response and after one month they called up again to tell me that it was an error at their end and they have shared a strong feedback to the back end team and removed the Max Fashion Gift Card buying option from their app, and shamelessly asked me to redeem it at offline store. I had asked them for full refund and they denied the same.

I have raised the complaint to RBI against Federal bank because One Card ( FPL Technologies Pvt. Ltd ) is not listed on RBI CMS portal.

Now the bigger problem is how these Fintech Collaboration is dangerous for Consumers as its managed by the amateur /unreliable Companies which are safe as they doesnt comes under the RBI system. On the other hand I think Federal Bank will deny any role in the issue as they are only the Credit Facility.

Any Expert opinion on the issue would be of great help.

I had recently purchased a Max fashion Gift Card from One Card App and read the terms and conditions mentioning its redeemable online on max fashion website.

On Redemption, it stated invalid Gift Card for which I raised a complaint to One Card.

One Card Customer Support Executive asked me contact Qwik silver Gift Card issuer directly and closed the ticket without any resolution.

After multiple follow ups, and raising the complaint to One Card Nodal Officer, they called and told me the Gift Card is redeemable only at offline stores.

I sent them the terms and conditions screenshot and App Video Recording, and they intentionally delayed the response and after one month they called up again to tell me that it was an error at their end and they have shared a strong feedback to the back end team and removed the Max Fashion Gift Card buying option from their app, and shamelessly asked me to redeem it at offline store. I had asked them for full refund and they denied the same.

I have raised the complaint to RBI against Federal bank because One Card ( FPL Technologies Pvt. Ltd ) is not listed on RBI CMS portal.

Now the bigger problem is how these Fintech Collaboration is dangerous for Consumers as its managed by the amateur /unreliable Companies which are safe as they doesnt comes under the RBI system. On the other hand I think Federal Bank will deny any role in the issue as they are only the Credit Facility.

Any Expert opinion on the issue would be of great help.