Shubham Chhapariya

KF Ace

Hi shubham here,

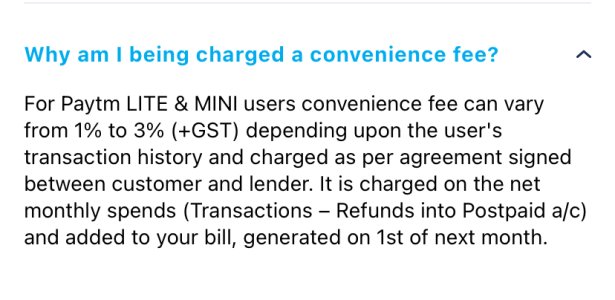

Paytm postpaid is one of the worst product one can use its just for name sake it says its 30days free credit to its user's but the catch is they charge a convience fee ranging between 1.5% to 3% user to user on the amount you used. Which in turn becomes a annual rate of 18% to 36%.

I would suggest never ever Activate or use this instead if need in urgent fund go for personal loan that would cost lesser then this.

Many app like Cred or Groww provides a loan for 1 to 4 years at much lesser rate then this. and the payout is also instant.

Has anyone used Paytm postpaid and whats your view?

Paytm postpaid is one of the worst product one can use its just for name sake it says its 30days free credit to its user's but the catch is they charge a convience fee ranging between 1.5% to 3% user to user on the amount you used. Which in turn becomes a annual rate of 18% to 36%.

I would suggest never ever Activate or use this instead if need in urgent fund go for personal loan that would cost lesser then this.

Many app like Cred or Groww provides a loan for 1 to 4 years at much lesser rate then this. and the payout is also instant.

Has anyone used Paytm postpaid and whats your view?