SayonB@97

KF Ace

Hi,

I have a HDFC credit card and my friend has an SBI credit card. I want to transfer my credit card bill to his SBI card just so that I can pay the bill using HDFC Net Banking (currently HDFC Net Banking does not support HDFC credit card bill payment) and get 1% cashback point in my debit card. I have 2 questions:

1. Will this any way harm or affect CIBIL score?

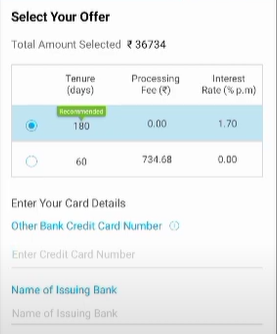

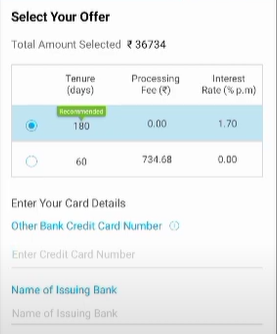

2. There are 2 options during SBI balance transfer - Balance Transfer & Balance Transfer on EMI. I chose Balance Transfer since I want to pay full amount right now. Then again I get 2 tenure options:

a. Tenure 60 days - some processing fees & 0% interest - I don't want to pay extra so will not choose this.

b. Tenure 180 days - No processing fees & 1.7%p.m. interest - I am unable to understand this option, so want help on this one. I can and will pay the bill on the SBI card on the same day I do the balance transfer. But will I still have to pay some interest amount with this option? Please help me understand this option, if any one is aware. I have attached the screenshot for reference.

I have a HDFC credit card and my friend has an SBI credit card. I want to transfer my credit card bill to his SBI card just so that I can pay the bill using HDFC Net Banking (currently HDFC Net Banking does not support HDFC credit card bill payment) and get 1% cashback point in my debit card. I have 2 questions:

1. Will this any way harm or affect CIBIL score?

2. There are 2 options during SBI balance transfer - Balance Transfer & Balance Transfer on EMI. I chose Balance Transfer since I want to pay full amount right now. Then again I get 2 tenure options:

a. Tenure 60 days - some processing fees & 0% interest - I don't want to pay extra so will not choose this.

b. Tenure 180 days - No processing fees & 1.7%p.m. interest - I am unable to understand this option, so want help on this one. I can and will pay the bill on the SBI card on the same day I do the balance transfer. But will I still have to pay some interest amount with this option? Please help me understand this option, if any one is aware. I have attached the screenshot for reference.