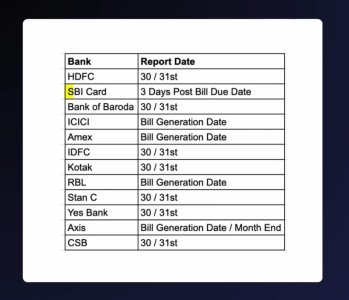

I want to maintain a credit utilization ratio between 1% and 9%. My bank, SBI, reports my utilization to credit bureaus 3 days after the due date.

Bill generation date: 18th of every month

Due date: 8th of the following month

Reporting date: 11th of the following month

If I maintain 7% utilization for November, it will be reflected in the December 18th bill and reported on January 11th.

If I use 80% of my credit limit between December 25th and January 2nd:

Will the 7% utilization still be reported on January 11th, or will the 80% be reported?

Should I reduce the balance below 9% before January 8th (due date) or January 18th (next bill date) to maintain an excellent ratio?

Bill generation date: 18th of every month

Due date: 8th of the following month

Reporting date: 11th of the following month

If I maintain 7% utilization for November, it will be reflected in the December 18th bill and reported on January 11th.

If I use 80% of my credit limit between December 25th and January 2nd:

Will the 7% utilization still be reported on January 11th, or will the 80% be reported?

Should I reduce the balance below 9% before January 8th (due date) or January 18th (next bill date) to maintain an excellent ratio?