AmritSaroe

KF Ace

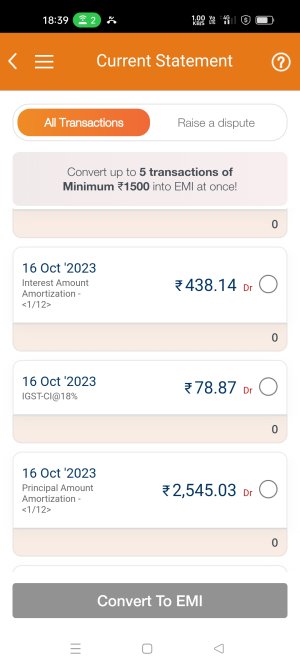

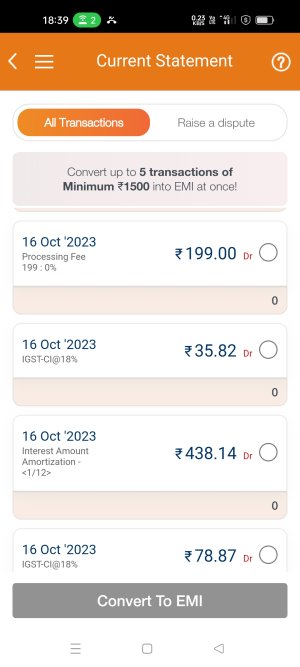

So through my research I found out that it's not actually "no cost" the interest part is paid by the manufacturers and I will be charged a convenience fees and 18% GST on the total interest part of the MRP ( I didn't quite understand what's this charge is and why are they charging it ).

Few more questions:

1. So my research was based on Bajaj emi card card but I think most banks provide the same facilities so, i should apply for the Bajaj card or should I?

2. If the MRP doesn't change after choosing "no cost EMI" option then it's a good option as the charges will be really low as compared to the interests that credit card companies charges. Is that right?

Few more questions:

1. So my research was based on Bajaj emi card card but I think most banks provide the same facilities so, i should apply for the Bajaj card or should I?

2. If the MRP doesn't change after choosing "no cost EMI" option then it's a good option as the charges will be really low as compared to the interests that credit card companies charges. Is that right?