You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Want to Know about charges on UPI Rupay Credit card transaction

- Thread starter alishasyed

- Start date

Gigachad

KF Mentor

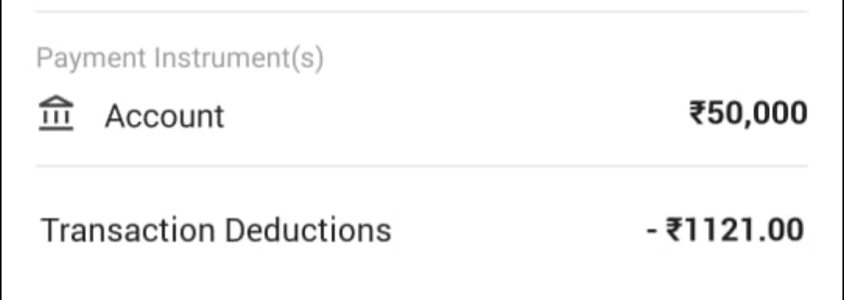

Depends on MCC.I have recently made a UPI transaction of 50000 using Rupay credit card but for Merchant Rs 1121 deducted as transaction charges

Does anyone has an idea on UPI Rupay credit card charges

Maybe they have fual mcc

17ysaurabh

KF Mentor

Did you exceed your credit card limit?I have recently made a UPI transaction of 50000 using Rupay credit card but for Merchant Rs 1121 deducted as transaction charges

Does anyone has an idea on UPI Rupay credit card charges

What kind of merchant payment was this?

alishasyed

KF Rookie

Credit limit not exceeded and I just bought plywood for my home interior works that was the payment to that merchantDid you exceed your credit card limit?

What kind of merchant payment was this?

Was the Merchant based in India or Outside India? Also was the payment made online or on POS Machine?I have recently made a UPI transaction of 50000 using Rupay credit card but for Merchant Rs 1121 deducted as transaction charges

Does anyone has an idea on UPI Rupay credit card charges

alishasyed

KF Rookie

In India only and mode of payment through QR scan only

Strange. This rules out the possibility of this being Currency Conversion Charges or MDR (usually applicable on POS machines).In India only and mode of payment through QR scan only

Will have to dig a little deeper on this

anuragmukherjee28

Moderator

The charges could be -

1) 1.1% fees is charged when UPI Rupay Credit card transaction is done , and when the amount is more than 2000 and its born by the merchant. (

2) Transaction processing fee - Payments accepted through RuPay credit cards over UPI may attract a processing fee which includes applicable taxes. This processing fee will be deducted from the settlement amount and it varies from seller to seller and from transactions to transaction

these 2 might be the reason for the transaction deduction

1) 1.1% fees is charged when UPI Rupay Credit card transaction is done , and when the amount is more than 2000 and its born by the merchant. (

2) Transaction processing fee - Payments accepted through RuPay credit cards over UPI may attract a processing fee which includes applicable taxes. This processing fee will be deducted from the settlement amount and it varies from seller to seller and from transactions to transaction

these 2 might be the reason for the transaction deduction

Chances of it being 1.1% fees for UPI credit card is low, as these charges are not supposed to be borne by customers (merchants pay for this). Additionally @alishasyed has been charged 1.90% + GST for this transaction.The charges could be -

1) 1.1% fees is charged when UPI Rupay Credit card transaction is done , and when the amount is more than 2000 and its born by the merchant. (

2) Transaction processing fee - Payments accepted through RuPay credit cards over UPI may attract a processing fee which includes applicable taxes. This processing fee will be deducted from the settlement amount and it varies from seller to seller and from transactions to transaction

these 2 might be the reason for the transaction deduction

Skylar

KF Master

Which bank?I have recently made a UPI transaction of 50000 using Rupay credit card but for Merchant Rs 1121 deducted as transaction charges

Does anyone has an idea on UPI Rupay credit card charges

zacobite

KF Mentor

above 2000 they charge extra.. upto 2% or more.. basis merchant.. UPI is good only for low value.. high value always use normal CCI have recently made a UPI transaction of 50000 using Rupay credit card but for Merchant Rs 1121 deducted as transaction charges

Does anyone has an idea on UPI Rupay credit card charges

Skylar

KF Master

is it 1.99% GST on amount above 2000?I am a shop owner so I have all upi apps merchant qr. so when a customer scans to pay merchant qr through rupay cc it gets 1.99% + GST MDR charges. 2-3 month i pay almost 10k on MDR charges. so i complain it and now my all merchant qr to disabled to accept rupay cc.

Ayan37

KF Expert

Yes if below 2000 no charge but if above 2000 then 1.99% + GST will be charged. If one thinks to do multiple transactions of 2000 then the total will be charged if payment is made from one card.is it 1.99% GST on amount above 2000?

Skylar

KF Master

Thats a problem for merchants. I should avoid UPI transactions with rupay cards for local vendors then and use it in only big mallsYes if below 2000 no charge but if above 2000 then 1.99% + GST will be charged. If one thinks to do multiple transactions of 2000 then the total will be charged if payment is made from one card.

and what is the charge if they swipe the card?

zacobite

KF Mentor

its the opposite.. use only at small places for low value.. high value use your normal cards..Thats a problem for merchants. I should avoid UPI transactions with rupay cards for local vendors then and use it in only big malls

and what is the charge if they swipe the card?

Aadi Yogi

KF Ace

Yes This is true that transaction charges are there in upi because when u make upi transaction using prepaid payment methods such as paytm, phone pay these fees covers the cost of processing accepting and authorization transaction as well as the maintenance of banking infrastructure this fee is usually about 0.5% to 1.1% transaction amount it comes under [ NPCI ] announced that 1.1 % charged on upi transaction over rs 2000.I have recently made a UPI transaction of 50000 using Rupay credit card but for Merchant Rs 1121 deducted as transaction charges

Does anyone has an idea on UPI Rupay credit card charges

muzammilsheikh

KF Ace

Bharat pay merchant QR code also charge 2%+GST even if transaction is inder 2000. It's depens on transaction, MDR charges aplicable for every transaction above 2000.

Similar threads

- Replies

- 2

- Views

- 640

- Replies

- 0

- Views

- 191

- Replies

- 0

- Views

- 206