ArinMandal

KF Rookie

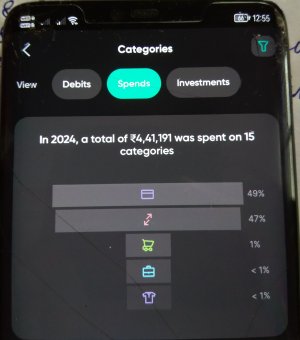

Hello, my name is Arin, and I am new to this community. I have a significant concern regarding UPI transactions. I have conducted transactions exceeding 6.2 lakh through UPI on my savings account, some for credit card bills and others for general UPI transactions. Currently, I am between jobs and not paying taxes. Could you assist me in understanding how much I can transact with my savings account to avoid reaching the income tax notification limit?