Gohel Gautam

KF Ace

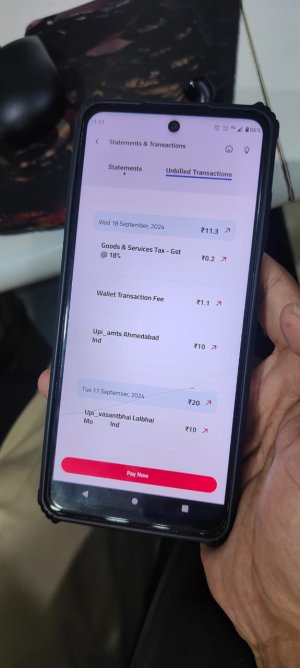

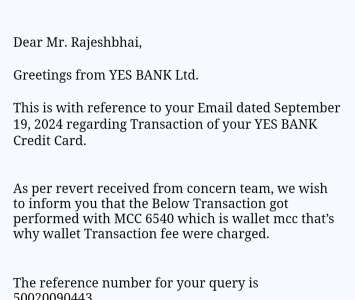

Yes Bank is deducting money, along with GST, from my "Rupay Credit Card" for transactions I haven't made, specifically wallet-related transactions.

I have spoken to customer care multiple times regarding this, but they do not provide a valid explanation. Whenever I request proof via email, they avoid my question and tell me, "If you want proof via email, please send an email with the details and they will respond."

One of the representatives called me and said, "It's just a small amount, why make a big deal out of it?"

This has happened 2-3 times now, and I have proof of all the deductions.

What should I do next? Is there any solutions?

I have spoken to customer care multiple times regarding this, but they do not provide a valid explanation. Whenever I request proof via email, they avoid my question and tell me, "If you want proof via email, please send an email with the details and they will respond."

One of the representatives called me and said, "It's just a small amount, why make a big deal out of it?"

This has happened 2-3 times now, and I have proof of all the deductions.

What should I do next? Is there any solutions?