NitishKumar

KF Ace

Hi Team,

Initially though of below LIC jeevan utsav plan to gift 50k/Annum for my daughter ,

--Invest 40k per annum till 13 years

--wait 14th and 15th year and from 16th year my daughter will receive 50k (yearly once) on her birthday till life long.

Now thinking of another option,

--Invest same 3333 (40000/12) Rs per month SIP (mostly only one fund) in Mutual Funds till 13 years. Later setup SWP for her.

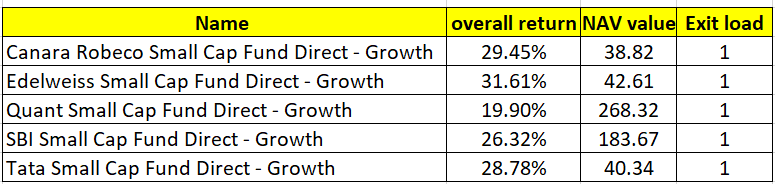

1) Now which one is best, either large or mid or small or flexi cap ? (also mention the fund name as well).

2) Can i start SIP on my daughter's name, she is 3.5 years old.

3) If NO, i will start SIP on my name and is there any option after 13 years i setup/transfer SWP on my daughter's name. so that amount will be credited to her account.

4) Is there any option in SWP to receive amount yearly once but not monthly?

Kindly reply to these 4 points.

Thanks in advance.

Initially though of below LIC jeevan utsav plan to gift 50k/Annum for my daughter ,

--Invest 40k per annum till 13 years

--wait 14th and 15th year and from 16th year my daughter will receive 50k (yearly once) on her birthday till life long.

Now thinking of another option,

--Invest same 3333 (40000/12) Rs per month SIP (mostly only one fund) in Mutual Funds till 13 years. Later setup SWP for her.

1) Now which one is best, either large or mid or small or flexi cap ? (also mention the fund name as well).

2) Can i start SIP on my daughter's name, she is 3.5 years old.

3) If NO, i will start SIP on my name and is there any option after 13 years i setup/transfer SWP on my daughter's name. so that amount will be credited to her account.

4) Is there any option in SWP to receive amount yearly once but not monthly?

Kindly reply to these 4 points.

Thanks in advance.